Korean Re is committed to promoting sound corporate governance practices so as to create enduring value for our business, clients, employees, and all other stakeholders. Governance fundamentally involves how Korean Re makes decisions and provides oversight of business management.

Governance Charter

In 2023, Korean Re established and promulgated its Governance Charter, a set of corporate governance principles, based on the recognition that establishing efficient and transparent governance is essential to protecting the interests of our stakeholders. The Governance Charter codifies the principles of shareholder and stakeholder protection, the roles and responsibilities of the Board of Directors and audit organization, and fair corporate activities, providing a benchmark for sound governance.

The management board of Korean Re will continue to carry out responsible management under the supervision of a professional and independent BOD, aiming for shared growth with stakeholders based on a sound governance framework.

Board Independence, Diversity, and Expertise

BOD Composition

Korean Re’s Board of Directors (BOD) is the company’s top decision-making body. It consists of seven members: two internal, one non-executive, and four external directors.

A director’s tenure is determined by the general shareholders’ meeting (GSM) within a range of three years, while external directors can serve for up to five years to ensure continuity in their functions.

The BOD deliberates and decides on matters prescribed by law or Articles of Incorporation, issues delegated by the GSM, and major issues related to the company’s management policies and business operations. The BOD also has the authority to appoint and dismiss the CEO and the chairman of the board.

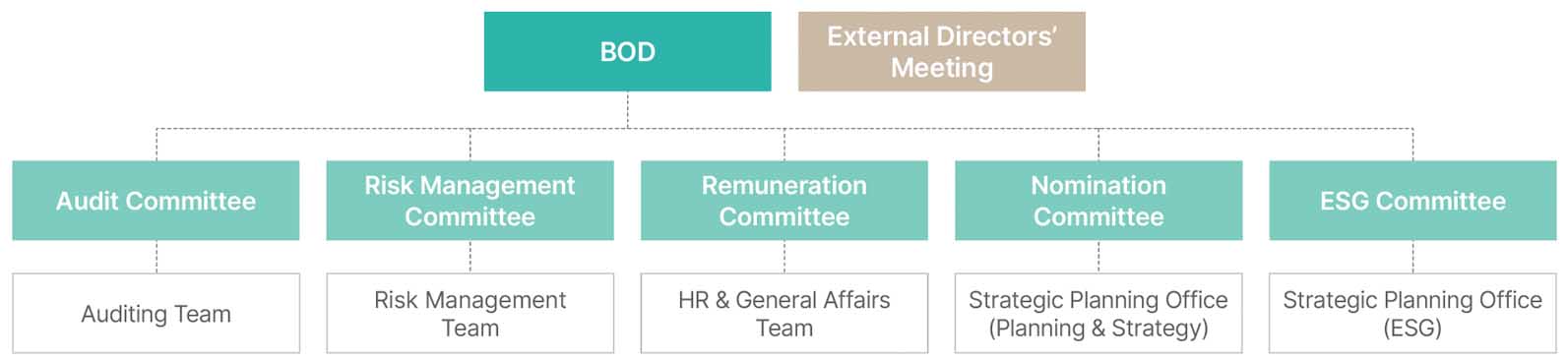

The BOD operates five subcommittees under it so as to ensure expertise and independence in its activities.

Independence

Over the years, Korean Re has enhanced the independence of its BOD by separating the roles of the CEO and the chair of the BOD, thereby strengthening the company’s accountability management system.

To establish effective checks and balances on management, the majority of the BOD consists of external directors, with the lead external director presiding over all regular meetings of the external directors.

All of the BOD’s committees, except the Nomination Committee, are entirely composed of external directors. When appointing two or more Audit Committee members at the annual GSM, they are elected independently.

Additionally, to strictly protect the committee’s independence, regulations prohibit re-voting on any decisions made by the Audit Committee.

Diversity and Expertise

Korean Re does not discriminate based on gender, age, or any other factors when nominating and appointing board member candidates. The current BOD includes one female external director, and we will continue to make sure that we have a balanced and inclusive governance structure.

The Nomination Committee ensures the selection of experts with extensive experience and knowledge in relevant fields, such as finance, insurance, accounting, and business management.

At least one member of the Audit Committee is a financial or accounting expert, as required by relevant laws and regulations, and members of the Risk Management Committee are selected from among BOD members who have a comprehensive understanding of risk management.

BOD and Executive Remuneration

Korean Re’s executive performance-based pay scheme aligns with the fundamental principles to balance with the company’s capital management. To that end, we peg the remuneration scheme to performance indicators that check profitability, sustainability, and soundness.

Notably, for sustainable growth, the key performance indicators (KPIs) for internal directors incorporate major ESG issues reviewed by the BOD, securing new growth drivers and business innovation. At the same time, Korean Re’s remuneration scheme considers the scope and nature of executives’ job duties, as well as their performance results, to determine their remuneration within the limits approved by the GSM.

Ethics and Compliance Governance

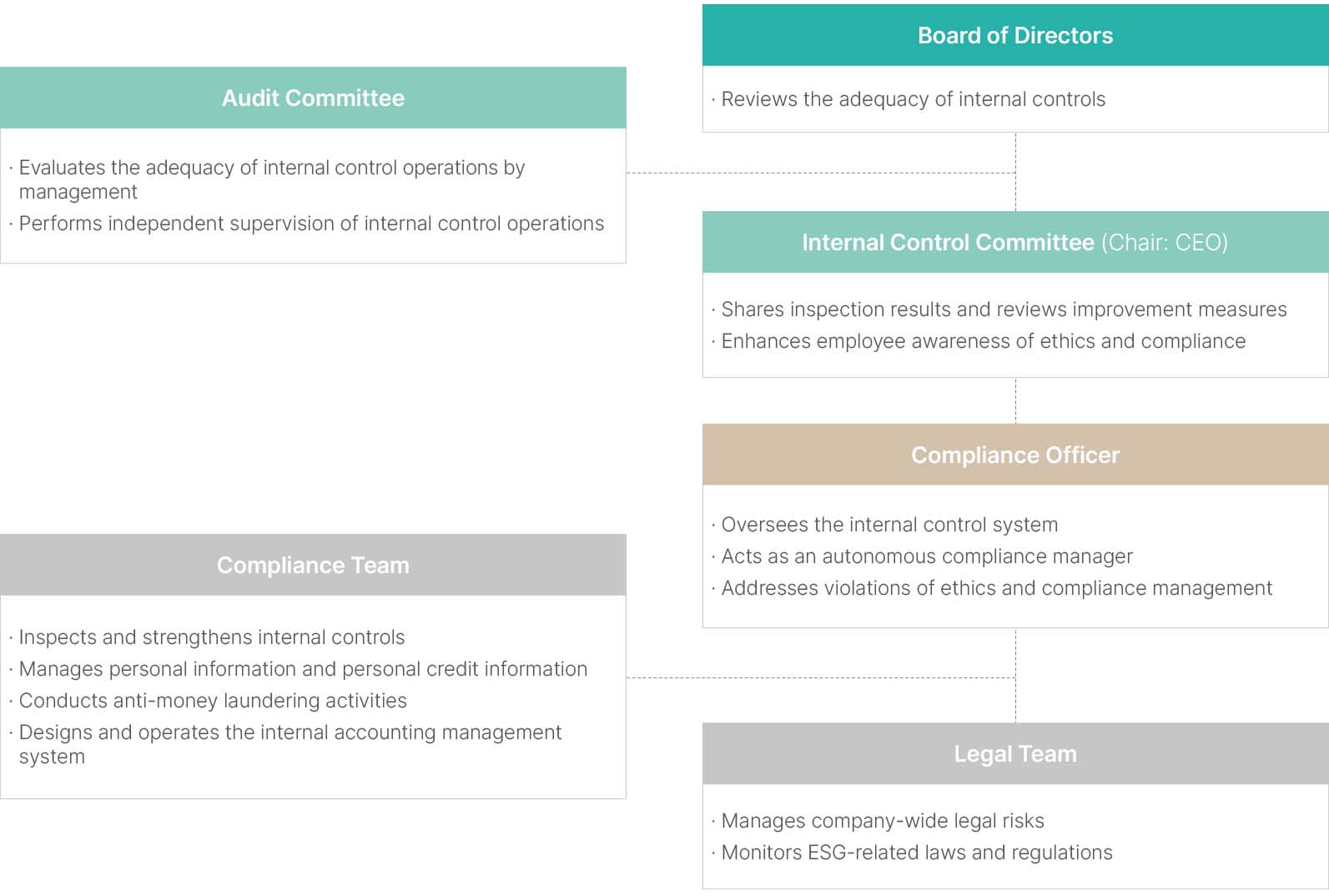

Korean Re convenes its Internal Control Committee, chaired by the CEO, semiannually to discuss major issues related to internal controls. The committee is responsible for continuous monitoring, inspection, and reporting of improvement measures concerning compliance, financial incidents, and internal control vulnerabilities. Additionally, the CEO reviews the internal control system and operations at least once a year, reporting the findings to the BOD.

The Audit Committee evaluates the adequacy of management’s operation of the internal control system and reports its findings and any deficiencies to the BOD. The committee also has the authority to independently oversee internal control operations as needed.

Korean Re appoints a Compliance Officer through a BOD resolution. The Compliance Officer is tasked with overseeing the internal control system and operations.

While the independence of this role is guaranteed to ensure the impartiality of his or her work, the Compliance Officer reports the compliance status of internal control regulations to the Audit Committee through pre-review procedures.

The Compliance Team handles the monitoring of internal controls, designing and operating internal accounting control systems, compliance tasks, fair trade compliance, and anti-money laundering efforts. For its part, the Legal Team proactively addresses legal risks by monitoring all related laws and regulations.

Ethics and Compliance Management

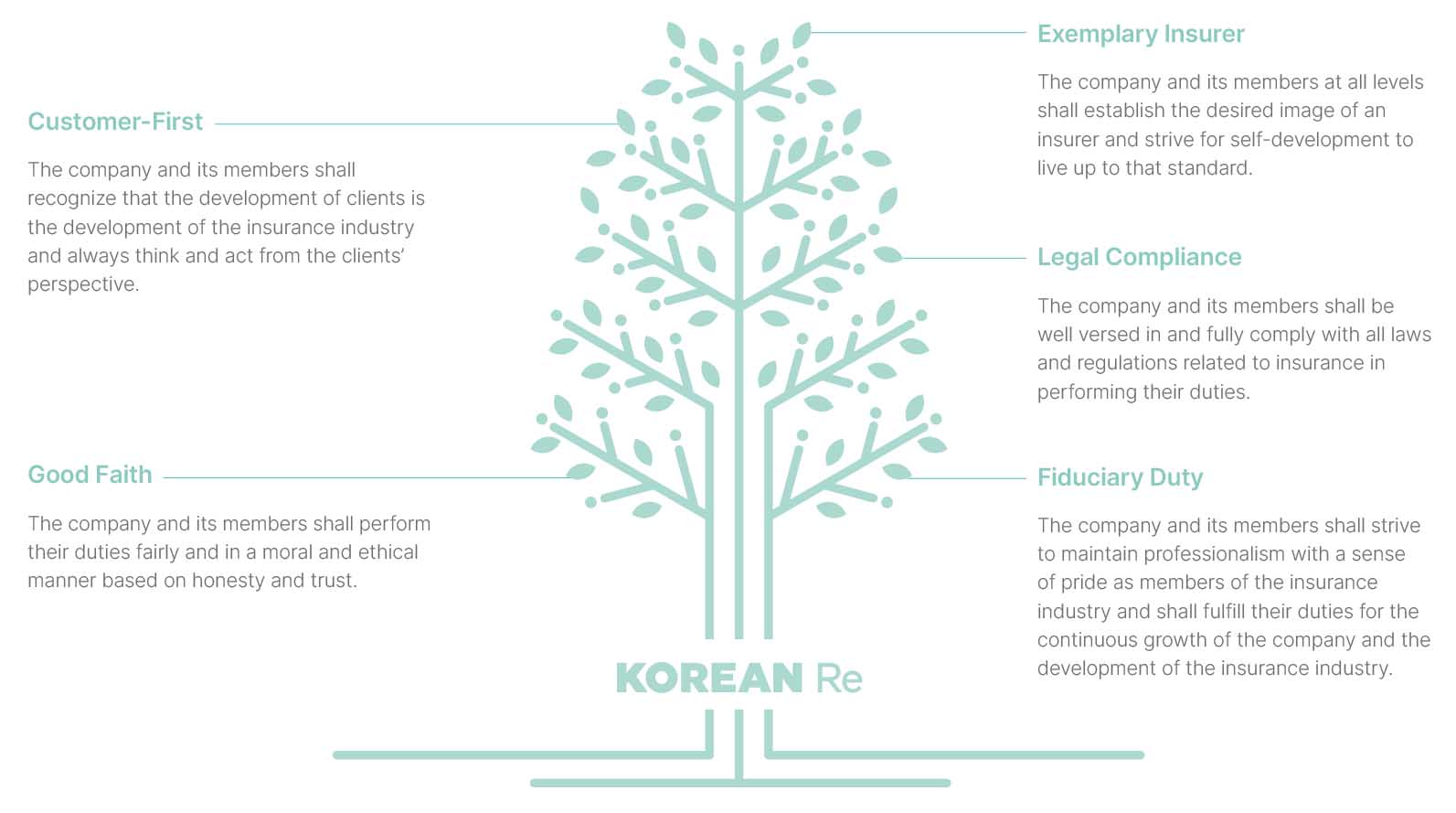

Korean Re aims to cultivate strong ethical awareness among employees in the promotion of an ethical and trustworthy society and the development of the insurance business through transparent, ethics-based management.

Grounded in principles of good faith, fiduciary duty, legal compliance, and a customer-first attitude, we have implemented a company-wide ethics and compliance management system to foster an esteemed culture of business ethics.

Compliance Practices

Fair Trade Compliance and Anti-Bribery Systems

Korean Re implements fair trade compliance and antibribery systems to achieve its business goals through fair and free competition. The Compliance Team ensures that there are no gaps in compliance management by conducting mandatory preliminary reviews of internal transactions between the company and its employees, affiliated groups, and related parties.

In addition, we conduct preliminary checks on all types of foreign transactions exceeding a certain threshold amount and, if necessary, report them to the relevant executives for further review. To reinforce our commitment to a culture of fair trade, Korean Re sends out biannual notices to all business partners, seeking their cooperation.

Anti-Money Laundering (AML) Measures

Korean Re has established its Anti-Money Laundering Task Processing Rules to prevent illegal money laundering through financial transactions and enhance transparency. Under these rules, we are required to report suspicious transactions and large cash transactions and implement internal control activities, including customer due diligence (CDD), to strictly prevent money laundering attempts.

We verify information on business partners located in noncooperative countries identified by the Financial Action Task Force (FATF)* to prevent any illegal or criminal activities related to money laundering in our operations.

* The Financial Action Task Force (FATF) was established in 1989 to combat money laundering and terrorist financing.