Property

UY2024 closed with the bottom line exceeding targets, as gross written premiums slightly increased from KRW 167 billion in 2023 to KRW 168 billion in 2024. This growth was backed by a rise in the number of new accounts written across all lines of business, as we continued to navigate opportunities in untapped markets. Our strict and conservative underwriting approach played a key role in achieving a favorable profit margin, with a technical combined ratio of 63.8%.

Our underwriting (U/W) guidelines for 2025 will remain unchanged, as our priority continues to be on bottom-line performance. Our U/W discipline is refined through risk selection, line size management, analysis of discrepancies between actual premium rates and technical rates, and coverage restrictions. We will take a conservative approach on high-hazardous occupations, as well as risks vulnerable to inflation and economic ups and downs, including those with high business interruption exposure.

Over the years, we have focused on tailoring our underwriting approach to align with regional preferences, allowing for greater flexibility in accessing new accounts. This strategy has led to creating opportunities across North America, where rates remained resilient and demand for new capacity grew higher than ever before.

We are also making good strides in terms of achieving a balanced regional portfolio, as North America and the Middle East and Africa (MEA) gradually replace our exposure in Asia and Europe.

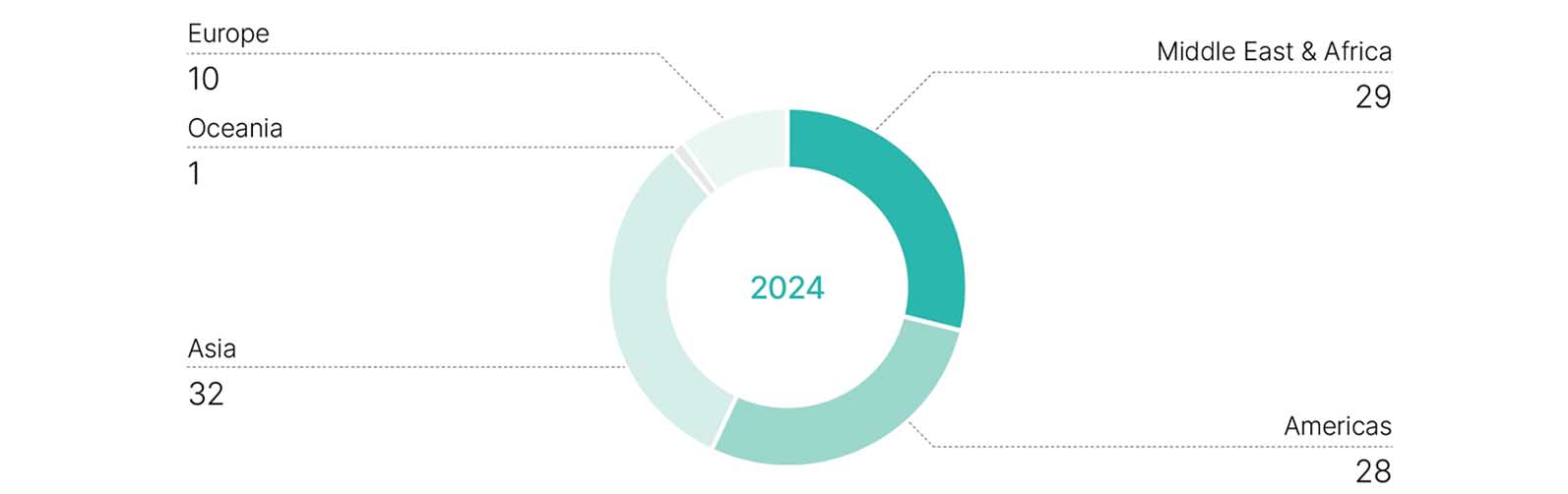

Our premium breakdown by territory is illustrated below, with Asia and MEA collectively accounting for more than half of the entire premium income, followed by the Americas (28%), Europe (10%), and Oceania (1%).

The favorable pricing momentum that once allowed us to achieve both growth and profitability has now largely come to an end. Market trends have varied across regions depending on their natural perils exposure. In catastrophe-prone regions with high natural catastrophe activity, flat renewals have become the ceiling for rate adjustments. On the other hand, in less catastrophe-prone regions, downward pricing pressure has intensified, with some areas experiencing double-digit reductions.

Between 2022 and 2023, we witnessed a significant increase in accounts seeking facultative coverage as a solution to tightened treaty requirements. While this trend benefited us to some extent, we remained focused on maintaining underwriting discipline, ensuring that our risk selection was grounded in stringent risk assessment and modeling.

As we move forward, various uncertainties arising from geopolitical events, catastrophic losses, and regulatory changes will continue to challenge our ability to attain our goals. Nevertheless, we are confident that we will stay committed to providing our clients with the underwriting expertise and capacity they need. These strengths have been at the core of our business success and will continue to serve as the bedrock of our long-term growth.

█ International Facultative Portfolio by Region in 2024 (Property)

(Unit: %)

█ Gross Written Premiums: International Property Facultative

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| International Property Facultative | 167.5 | 122.4 | 167.1 | 126.6 |

█ Gross Written Premiums: International Property Facultative

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

International Property Facultative |

167.5 |

122.4 |

167.1 |

126.6 |

Engineering & Construction

In 2024, Korean Re’s international engineering and construction facultative business maintained a strategic focus on enhancing profitability. Our market positioning was driven by a shift toward portfolio optimization, emphasizing disciplined underwriting and risk selection. By prioritizing quality over volume, we strategically aligned our business with the most favorable opportunities, reinforcing our commitment to sustainable underwriting profitability. While market hardening has shown signs of plateauing, we continue to leverage prevailing market conditions to strengthen our competitive position and drive long-term value creation.

The global construction market is showing signs of stabilization, but the outlook for mega projects in our key target regions remains promising. With the rapid advancement of emerging technologies, we anticipate significant investments in supporting infrastructure, which will drive long-term growth in the construction sector. These developments present substantial opportunities for Korean Re as we continue to align our business with industry trends and capitalize on evolving market demands.

While eco-friendly construction methods and renewable energy projects remain a focal point amid the increasing emphasis on environmental, social, and governance (ESG) initiatives, traditional power generation and energy investments are also gaining renewed attention. With the new U.S. administration prioritizing infrastructure and energy security, significant investments are expected in conventional power generation and oil & gas projects. At the same time, improvements in global supply chain conditions—following the peak disruptions of previous years—are fostering a more stable environment for large-scale developments worldwide. While geopolitical uncertainties remain, sustained infrastructure spending and energy-sector investments continue to underpin market growth, creating long-term opportunities in the construction industry.

Looking ahead, we are focused on achieving sustainable and profitable growth in 2025. Our commitment to maintaining relevance in the market is reflected in our continued efforts to strengthen long-term partnerships and deliver meaningful value to our key clients worldwide. To support this strategy, we will actively manage our portfolio by closely monitoring early indicators of changes in loss ratio trends and exposure to natural catastrophes. This disciplined approach is reinforced by seamless collaboration between our claims team, risk engineers, and underwriters, ensuring we stay agile in an evolving market landscape.

█ Gross Written Premiums: International Engineering & Construction Facultative

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| International Engineering & Construction Facultative | 85.2 | 62.3 | 110.0 | 83.4 |

█ Gross Written Premiums: International Engineering & Construction Facultative

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

International Engineering & Construction Facultative |

85.2 |

62.3 |

110.0 |

83.4 |

Marine & Energy

The global marine insurance market expanded in 2024 as rising maritime activity and inflation-driven asset values increased total premiums. However, competitive pressures led to softening rates, creating a challenging pricing environment. In particular, the upstream energy market came under significant downward pressure on pricing during 2024, as insurers pursued top-line growth in a sector that had performed strongly in recent years. The market is evidently on a softening trend, increasing insurer competition and creating more options for insureds, while rising claims costs due to economic inflation are straining insurers.

A tug-of-war between insureds and insurers will lead to a varied spectrum of balance based on tensions between premium affordability for insureds and insurers’ need for sustainable pricing, while navigating geopolitical challenges. We are witnessing an increasingly wider divergence in pricing between premium accounts with strong risk management practices and those with less transparency in the treatment of risk.

Despite these market conditions, our international marine and energy business achieved robust growth in 2024, with gross written premiums increasing by 15.9% year on year to KRW 78.0 billion. One of the key drivers behind the growth was our commitment to expanding our portfolio into wind turbine installation and offshore wind farms as part of our initiative to embrace the carbon-neutral movement. Furthermore, the stabilization of global oil and gas prices at USD 70-80, compared to the COVID-19 pandemic lows of USD 30-35, has spurred project activity in the upstream energy sector. This resurgence has fueled demand for upstream energy insurance, a trend expected to continue over the next few years.

As previously noted, the capacity glut and consistent profitability in the markets have increased pressure on signing desired shares, making it challenging for insurers to achieve growth. In the midst of fierce competition, we remained steadfast in our focus on ensuring underwriting profitability and protecting our signed lines, which resulted in a technical profit of KRW 11.5 billion before management expenses.

We are committed to continuously re-underwriting underperforming sub-classes, and, at the same time, capturing new opportunities, especially in energy transition and renewables. We are taking steps to tap into the fast-growing offshore wind farm and offshore electricity transmission sectors as the renewable market becomes more disciplined in response to the evolution of new technologies. We are confident that we can achieve stable growth and profitability by proactively adjusting our portfolio mix between conventional risks and green technology risks.

█ Gross Written Premiums: International Marine & Energy Facultative Business

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| International Marine & Energy Facultative | 78.0 | 57.0 | 67.3 | 51.0 |

█ Gross Written Premiums: International Marine & Energy Facultative Business

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

International Marine & Energy Facultative |

78.0 |

57.0 |

67.3 |

51.0 |