Vision and Strategy

Korean Re has redefined its vision to align with a more forward-looking and value-driven approach. Moving beyond our previous ranking-oriented objectives, we have set our sights on becoming a global top-tier reinsurer, emphasizing qualitative excellence over mere quantitative expansion. Rather than focusing solely on premium size, we aim to establish ourselves as a leader in all aspects of reinsurance, achieving the highest global standards in underwriting expertise, financial soundness, and client service.

To embody this vision in our strategies and corporate mindset, we have adopted the mid-term strategic slogan “Challenge Ourselves, Change the World.” This slogan reflects our unwavering commitment to innovation, continuous self-improvement, and delivering unparalleled value to our clients. We are determined to push beyond conventional limits, embrace transformation, and proactively drive meaningful change in the global reinsurance industry.

A key pillar of our future strategy is the continued expansion of our global footprint. We will reinforce our overseas market presence, strengthen local partnerships, and enhance our portfolio to achieve sustainable growth across diverse markets. Through disciplined risk management and portfolio optimization, we seek to navigate evolving industry landscapes while securing long-term profitability.

Furthermore, we are committed to high-quality management and operational excellence. By investing in advanced analytics, digital transformation, and talent development, we will enhance our competitiveness and adaptability in an increasingly complex risk environment. Our approach is not merely about keeping pace with industry changes but actively shaping them to create long-term value.

Through these and other related efforts, Korean Re aspires to make a lasting impact on the reinsurance industry and beyond, contributing to the resilience and advancement of global economies and communities. With a vision grounded in excellence and innovation, we will continue our journey toward establishing ourselves as a truly top-tier global reinsurer.

Overview of Business Environment

In 2024, the Korean insurance market experienced moderate growth, driven by positive performance in both the life and non-life sectors. The growth in the life insurance market was fueled by continued strong sales of health insurance products, as life insurers focused on higher-margin protection products under IFRS 17. Additionally, both savings insurance and variable insurance recovered from previous contractions, while retirement annuities experienced a decline in premium income. In the non-life insurance market, long-term insurance and general property and casualty insurance delivered steady growth, but retirement annuities and motor insurance saw a reduction in premium income.

Meanwhile, there was a notable increase in demand for liability insurance, such as indemnity and compensation coverage.

Market profitability increased in 2024 compared to the previous year, supported by improvements in investment performance. Both life and non-life insurers benefited from a substantial rise in investment gains in spite of weaker insurance service results. Investment results significantly improved thanks to an increase in interest and dividend income.

The insurance industry continued to adapt to the new regulatory framework established in 2023. With IFRS 17 in effect, insurers have been focusing on portfolio profitability and high-margin product development. In addition, under K-ICS, insurers are actively managing capital adequacy through measures such as issuing subordinated bonds, utilizing hybrid capital securities, and expanding the use of reinsurance and coinsurance. Even though the industry has demonstrated solid financial performance, insurers are expected to remain cautious amid ongoing economic uncertainties, including financial market fluctuations and real estate-related risks.

Highlights of Business Results

█ Key Figures

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Gross Written Premiums |

7,924.8 |

5,791.1 |

8,539.0 |

6,471.7 |

Insurance Revenue (gross)1) |

5,136.6 |

3,753.6 |

5,167.6 |

3,916.6 |

Insurance Service Result (net) |

198.7 |

145.2 |

206.2 |

156.3 |

Insurance Finance Result (net) 2) |

-183.5 |

-134.1 |

-114.3 |

-86.6 |

Technical Result 2) |

15.2 |

11.1 |

91.9 |

69.7 |

Investment Income 3) |

389.3 |

284.5 |

263.8 |

200.0 |

Net Income |

316.7 |

231.4 |

283.9 |

215.1 |

ROE |

9.4% |

9.5% |

||

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) Excluding the insurance finance result and gain/losses from foreign exchange and interest rate hedging for insurance liabilities

█ Key Figures

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Gross Written Premiums | 7,924.8 | 5,791.1 | 8,539.0 | 6,471.7 |

| Insurance Revenue (gross)1) | 5,136.6 | 3,753.6 | 5,167.6 | 3,916.6 |

| Insurance Service Result (net) | 198.7 | 145.2 | 206.2 | 156.3 |

| Insurance Finance Result (net) 2) | -183.5 | -134.1 | -114.3 | -86.6 |

| Technical Result 2) | 15.2 | 11.1 | 91.9 | 69.7 |

| Investment Income 3) | 389.3 | 284.5 | 263.8 | 200.0 |

| Net Income | 316.7 | 231.4 | 283.9 | 215.1 |

| ROE | 9.4% | 9.5% | ||

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) Excluding the insurance finance result and gain/losses from foreign exchange and interest rate hedging for insurance liabilities

Throughout the year, Korean Re focused on strengthening its business portfolios with the goal of enhancing the profitability of its overall insurance business and improving investment performance. As a result, our top-line revenue slightly declined in 2024 compared to the prior year, but our bottom-line performance improved. Our gross written premium (GWP) decreased by 7.2% year on year to KRW 7,924.8 billion, while insurance revenue declined by 0.6% to KRW 5,136.6 billion. However, our net income increased by 11.6% to KRW 316.7 billion, with a return on equity (ROE) of 9.4%.

Our technical result, which includes the insurance service result and insurance finance result, declined by KRW 76.8 billion year on year to a profit of KRW 15.2 billion in 2024. The decline was spurred by a deficit in L&H reinsurance, stemming from a proactive valuation adjustment of a certain overseas life portfolio. In contrast, P&C reinsurance delivered a solid performance due to the impact of a reduced loss ratio driven by hard market conditions both domestically and internationally.

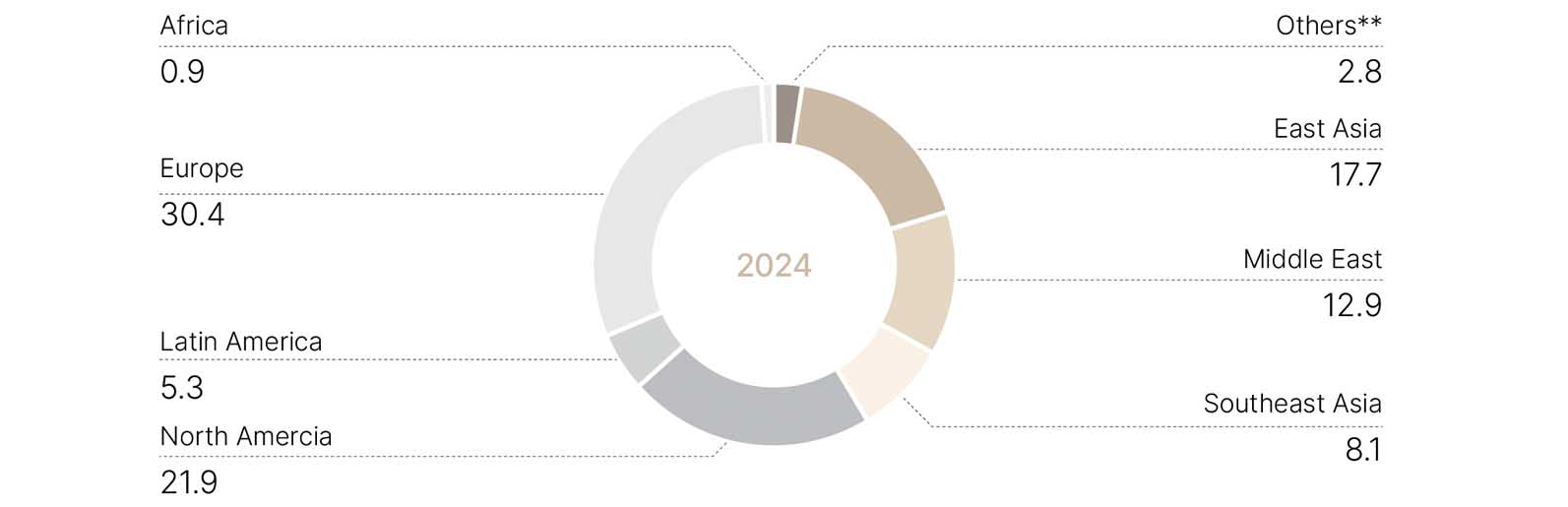

Meanwhile, active portfolio management enabled us to diversify our global business portfolio, increasing our presence in Europe and the Americas, which accounted for a greater share of the total business. According to a geographical breakdown of our gross written premiums, markets in Europe and the Americas accounted for 30.4% and 27.2%, respectively, of the entire overseas business portfolio in 2024. Their combined share reached 57.6% in 2024 compared to 42.2% in 2019. It is also noteworthy that the share of the Asian market declined to 38.8% in 2024 compared to the previous year as a result of our portfolio adjustments aimed at improving overall business results.

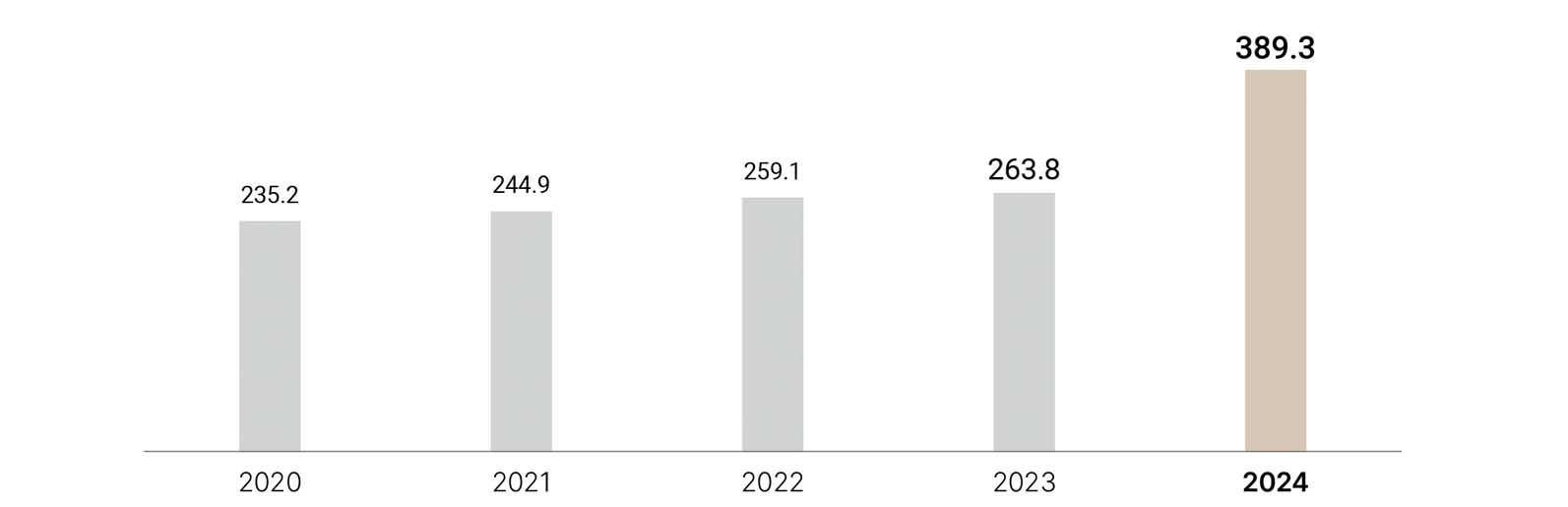

We achieved a high level of investment returns, amounting to KRW 389.3 billion in investment income. The year-over-year increase in investment income was KRW 125.5 billion, driven by a higher book yield and growth in invested assets. We conducted bond portfolio rebalancing in 2024, which was smaller in scale than in 2023, in anticipation of a gradual decline in interest rates, resulting in a slight improvement in book yield.

The total value of our assets continued to grow in line with our business growth. We reported KRW 13,160.4 billion in total assets as of the end of 2024, up KRW 1,094.1 billion year over year. There was a substantial increase of KRW 1,100.4 billion in invested assets, which totaled KRW 10,834.1 billion. This growth was mainly driven by an increase in net cash inflows from insurance operations and asset valuation gains following changes in foreign exchange rates and interest rates. Moreover, we maintained our capital position at a stable level, with total shareholders’ equity increasing to KRW 3,452.9 billion as of the end of December 2024. The substantial growth in total shareholders’ equity from the previous year is primarily due to our strong net income performance.

█ Overseas Business Portfolio* by Region in 2024

(Unit: %)

* Based on gross written premiums

** Others include multi-territory accounts.

█ Breakdown of Insurance Revenue

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | YoY Change 4) | |

| Domestic Property 1) | 529.9 | 387.2 | 528.0 | 400.2 | 0.4% |

| Domestic Engineering, Marine & Aviation | 584.9 | 427.4 | 547.7 | 415.1 | 6.8% |

| Domestic Casualty | 472.0 | 344.9 | 501.1 | 379.8 | -5.8% |

| Domestic Motor, Surety & Agriculture | 618.0 | 451.6 | 805.1 | 610.2 | -23.2% |

| International Treaty | 831.2 | 607.4 | 772.6 | 585.5 | 7.6% |

| International Facultative | 271.5 | 198.4 | 268.8 | 203.7 | 1.0% |

| Long-Term | 613.3 | 448.2 | 522.8 | 396.3 | 17.3% |

| Financial Solutions | 30.4 | 22.2 | 13.9 | 10.6 | 118.7% |

| Domestic Life & Health | 292.5 | 213.7 | 287.4 | 217.8 | 1.8% |

| Overseas Life & Health | 438.0 | 320.1 | 503.0 | 381.2 | -12.9% |

| Overseas Operations 2) |

454.9 | 332.5 | 417.2 | 316.3 | 9.0% |

| Total 3) | 5,136.6 | 3,753.6 | 5,167.6 | 3,916.6 | -0.6% |

1) Domestic property covers Korean Interest Abroad (KIA) and nuclear insurance, which includes some overseas business.

2) Overseas operations include KRUL, KRSA, and branches in Singapore, Labuan, Dubai, and Shanghai.

3) Individual figures may not add up to the total shown due to rounding.

4) YoY change is based on the value in KRW..

█ Breakdown of Insurance Revenue

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

YoY Change 4) |

|

Domestic Property 1) |

529.9 |

387.2 |

528.0 |

400.2 |

0.4% |

Domestic Engineering, Marine & Aviation |

584.9 |

427.4 |

547.7 |

415.1 |

6.8% |

Domestic Casualty |

472.0 |

344.9 |

501.1 |

379.8 |

-5.8% |

Domestic Motor, Surety & Agriculture |

618.0 |

451.6 |

805.1 |

610.2 |

-23.2% |

International Treaty |

831.2 |

607.4 |

772.6 |

585.5 |

7.6% |

International Facultative |

271.5 |

198.4 |

268.8 |

203.7 |

1.0% |

Long-Term |

613.3 |

448.2 |

522.8 |

396.3 |

17.3% |

Financial Solutions |

30.4 |

22.2 |

13.9 |

10.6 |

118.7% |

Domestic Life & Health |

292.5 |

213.7 |

287.4 |

217.8 |

1.8% |

Overseas Life & Health |

438.0 |

320.1 |

503.0 |

381.2 |

-12.9% |

OverseasOperations 2) |

454.9 |

332.5 |

417.2 |

316.3 |

9.0% |

Total 3) |

5,136.6 |

3,753.6 |

5,167.6 |

3,916.6 |

-0.6% |

1) Domestic property covers Korean Interest Abroad (KIA) and nuclear insurance, which includes some overseas business.

2) Overseas operations include KRUL, KRSA, and branches in Singapore, Labuan, Dubai, and Shanghai.

3) Individual figures may not add up to the total shown due to rounding.

4) YoY change is based on the value in KRW..

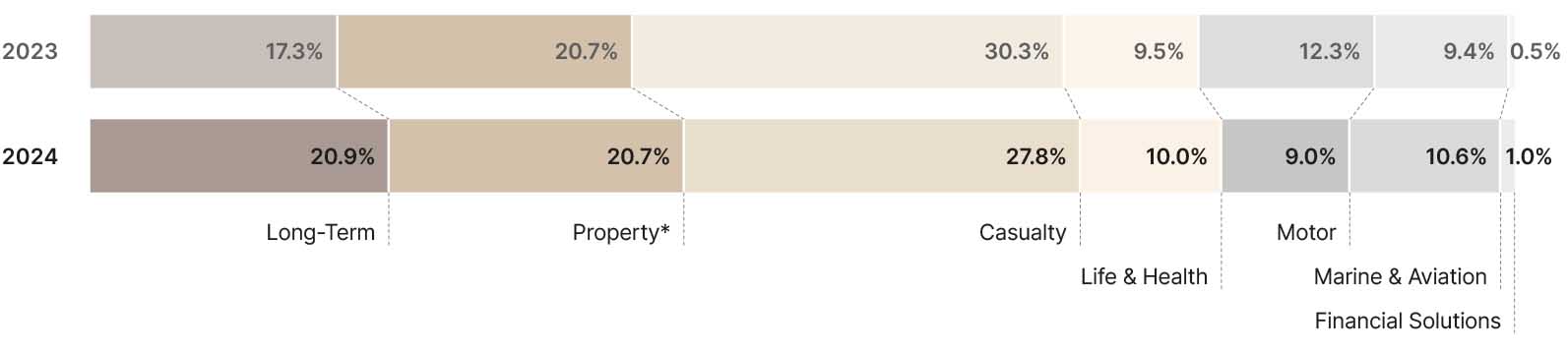

█ Domestic Insurance Revenue Portfolio by Line of Business

* Property includes engineering and nuclear.

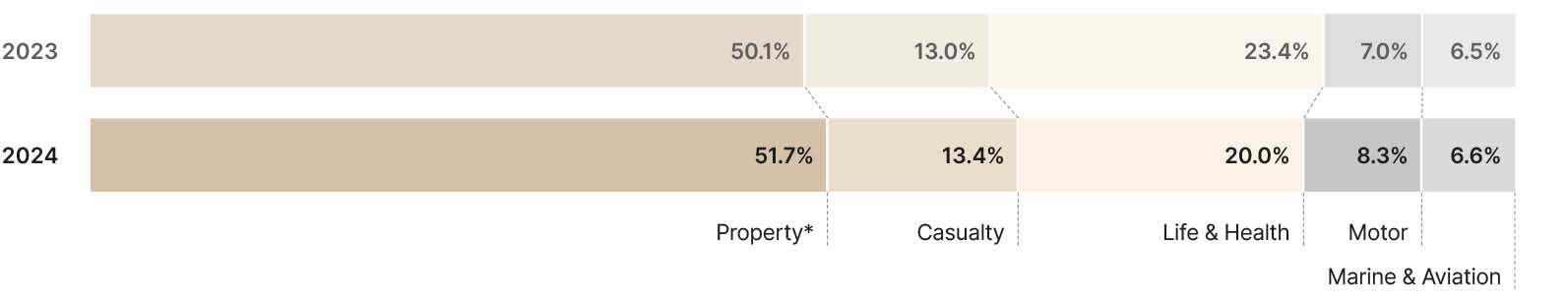

█ Overseas Insurance Revenue Portfolio by Line of Business

* Property includes engineering and nuclear.

Analysis of Business Results

Property and Casualty (P&C) Reinsurance

█ P&C Key Figures

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Insurance Revenue (gross) 1) | 3,762.3 | 2,749.4 | 3,840.5 | 2,910.7 |

| Domestic | 2,020.3 | 1,476.3 | 2,197.4 | 1,665.4 |

| Overseas | 1,742.1 | 1,273.0 | 1,643.1 | 1,245.3 |

| Insurance Service Result (net) | 265.1 | 193.7 | 83.9 | 63.6 |

| Insurance Finance Result (net) 2) | -65.1 | -47.6 | -28.7 | -21.8 |

| Technical Result 2) | 200.0 | 146.1 | 55.2 | 41.8 |

| Combined Ratio (%) 3) | 89.1 | 94.4 | ||

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) The combined ratio is calculated as insurance service expenses (net) divided by insurance revenue (net). The 2023 figure has been restated due to a change in the calculation method.

█ P&C Key Figures

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Insurance Revenue (gross) 1) |

3,762.3 |

2,749.4 |

3,840.5 |

2,910.7 |

Domestic |

2,020.3 |

1,476.3 |

2,197.4 |

1,665.4 |

Overseas |

1,742.1 |

1,273.0 |

1,643.1 |

1,245.3 |

Insurance Service Result (net) |

265.1 |

193.7 |

83.9 |

63.6 |

Insurance Finance Result (net) 2) |

-65.1 |

-47.6 |

-28.7 |

-21.8 |

Technical Result 2) |

200.0 |

146.1 |

55.2 |

41.8 |

Combined Ratio (%) 3) |

89.1 |

94.4 |

||

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) The combined ratio is calculated as insurance service expenses (net) divided by insurance revenue (net). The 2023 figure has been restated due to a change in the calculation method.

Our P&C insurance revenue decreased from KRW 3,840.5 billion in 2023 to KRW 3,762.3 billion in 2024, marking a 2.0% decline. Domestic insurance revenue fell by 8.1% to KRW 2,020.3 billion in 2024 due to portfolio adjustments. Throughout the year, we placed a strategic focus on strengthening our business portfolios and improving our long-term profitability. Accordingly, we restricted growth targets to prioritize reinforcing our business fundamentals and significantly reduced our underwriting volume for products with low profitability.

On the other hand, overseas P&C insurance revenue increased by 6.0% to KRW 1,742.1 billion in 2024, driven by the expansion of new treaties and rate increases. This growth in the overseas market partially offset our revenue decline in the domestic market.

The P&C insurance service result saw a substantial increase to KRW 265.1 billion in 2024, marking a 215% growth. This reflects a major improvement in underwriting profitability. The technical result also grew by 262% to KRW 200.0 billion in 2024.

As a result, the combined ratio improved from 96.4% in 2023 to 89.1% in 2024. A combined ratio below 100% indicates profitability in insurance operations, demonstrating a significant enhancement in overall business efficiency.

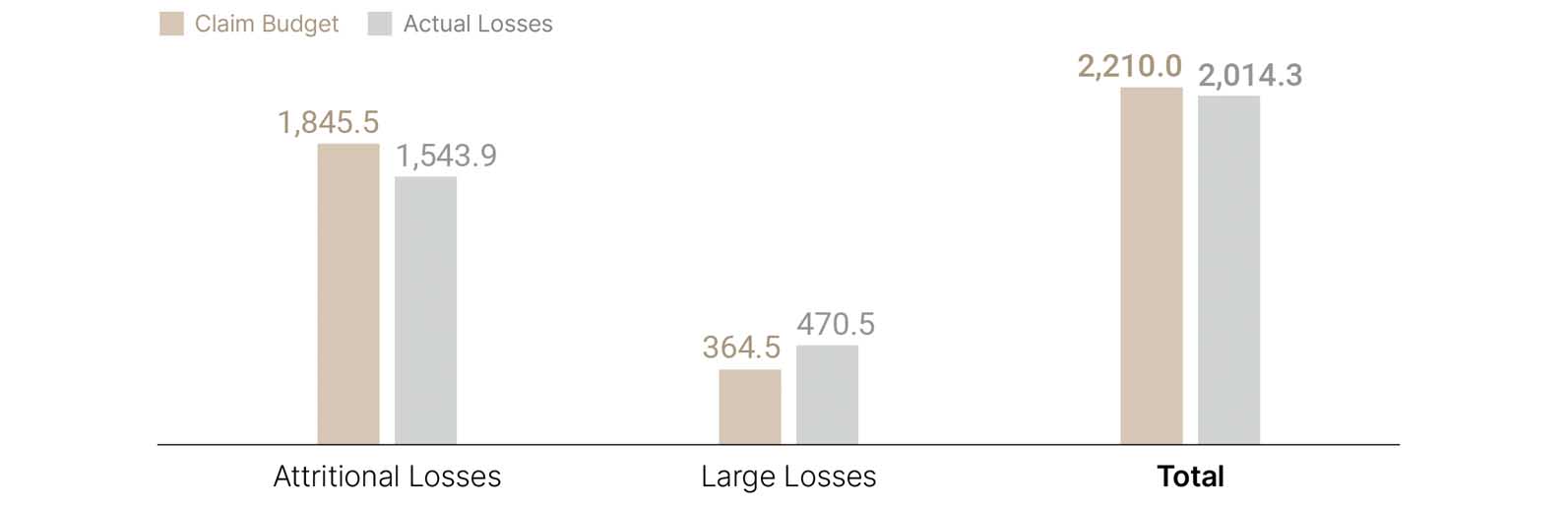

Upon reviewing our claim budget, which is planned at the beginning of each year, it is evident that P&C insurance service profit was driven by a reduction in attritional losses in 2024. The claim budget refers to the annually established acceptable level of losses to achieve profit targets. In 2024, only 84% of the claim budget for attritional losses was consumed, with actual attritional losses amounting to KRW 1,543.9 billion. This smaller-than-expected volume of attritional losses contributed to an overall decrease in losses. However, large losses exceeded our budgeted expectations in 2024 due to unusual events such as the Middle East floods (notably in Dubai) and significant loss creep related to the 2023 hailstorm in Italy.

█ Major Large Losses in 2024

(Units: KRW billion, USD million)

| Major Large Losses | Month of Loss | 2024 (KRW) | 2024 (USD) |

| Dubai Flood | April 2024 | 52.8 | 38.6 |

| Italy Hailstorm | July 2023 | 39.6 | 28.9 |

| Typhoon Yagi | September 2024 | 31.6 | 23.1 |

█ Major Large Losses in 2024

(Units: KRW billion, USD million)

Major Large Losses |

Month of Loss |

2024 (KRW) |

2024 (USD) |

Dubai Flood |

April 2024 |

52.8 |

38.6 |

Italy Hailstorm |

July 2023 |

39.6 |

28.9 |

Typhoon Yagi |

September 2024 |

31.6 |

23.1 |

█ Claim Budget vs Actual Losses in 2024

(Unit: KRW billion)

Building on the progress we made in 2024, we look forward to further strengthening our underwriting performance in the years to come. The market has been responding to increasing claims costs by correcting prices and restricting terms and conditions. In step with these market movements, we will continue to exercise strong underwriting discipline to improve our technical profitability. Favorable pricing movements, coupled with our strictly disciplined approach to underwriting, will position our business to generate solid results going forward.

Life and Health (L&H) Reinsurance

In 2024, the insurance revenue of Life and Health (L&H) increased by 3.5% to KRW 1,374.2 billion compared to 2023. Domestic L&H insurance grew by 13.6% due to an increase in jointly developed long-term products, while overseas L&H insurance declined by 12.9% due to the termination of underperforming contracts.

From a profit and loss perspective, we delivered a weak performance in 2024, with the L&H insurance technical result recording a deficit of KRW 184.8 billion. In particular, we made a precautionary value adjustment for an unprofitable overseas life portfolio that could incur additional losses in the future. This led to the additional recognition of the liability for incurred claims.

Following the introduction of IFRS 17, revenue recognition in L&H shifted from simple settlement of premiums and claims to the amortization of the Contractual Service Margin (CSM), a liability that reflects future profits under the new accounting regime. As the CSM is released into earnings as insurance contracts are fulfilled as expected, it is an important indicator of future insurance business results.

To ensure the robust management of the CSM, which forms the foundation of future earnings, we are committed to meticulously analyzing the intrinsic value of each contract from an actuarial perspective and then incorporating the results into our portfolio strategy. When acquiring new treaties, we measure the Value of New Business (VNB) to verify if the incoming CSM aligns with our targets. For our in-force treaties, we identify loss-making contracts that negatively impact the CSM through the measurement of the Value of In-Force Business (VIF).

By the end of 2024, the CSM rose by 15% to KRW 953.0 billion compared to the previous year-end figure. The increase can be attributed primarily to the growth in our long-term business and a new coinsurance transaction with a global life insurer in 2024. In light of the CSM movement, we plan to actively manage the CSM by focusing on acquiring high-margin treaties.

█ L&H Key Figures

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Insurance Revenue (gross) 1) | 1,374.2 | 1,004.2 | 1,327.1 | 1,005.8 |

| Domestic | 936.2 | 684.1 | 824.1 | 624.6 |

| Overseas | 438.0 | 320.1 | 503.0 | 381.2 |

| Insurance Service Result (net) | -66.4 | -48.5 | 122.3 | 92.7 |

| Insurance Finance Result (net) 2) | -118.4 | -86.5 | -85.6 | -64.9 |

| Technical Result 2) | -184.8 | -135.1 | 36.7 | 27.8 |

| Combined Ratio (%) 3) | 105.0 | 90.4 | ||

| Contractual Service Margin (net) | 953.0 | 642.0 | 828.8 | 636.5 |

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) The combined ratio is calculated as insurance service expenses (net) divided by insurance revenue (net). The 2023 figure has been restated due to a change in the calculation method.

█ L&H Key Figures

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Insurance Revenue (gross) 1) |

1,374.2 |

1,004.2 |

1,327.1 |

1,005.8 |

Domestic |

936.2 |

684.1 |

824.1 |

624.6 |

Overseas |

438.0 |

320.1 |

503.0 |

381.2 |

Insurance Service Result (net) |

-66.4 |

-48.5 |

122.3 |

92.7 |

Insurance Finance Result (net) 2) |

-118.4 |

-86.5 |

-85.6 |

-64.9 |

Technical Result 2) |

-184.8 |

-135.1 |

36.7 |

27.8 |

Combined Ratio (%) 3) |

105.0 |

90.4 |

||

Contractual Service Margin (net) |

953.0 |

642.0 |

828.8 |

636.5 |

1) Income from insurance contracts issued

2) Excluding exchange rate effects

3) The combined ratio is calculated as insurance service expenses (net) divided by insurance revenue (net). The 2023 figure has been restated due to a change in the calculation method.

Investment Performance

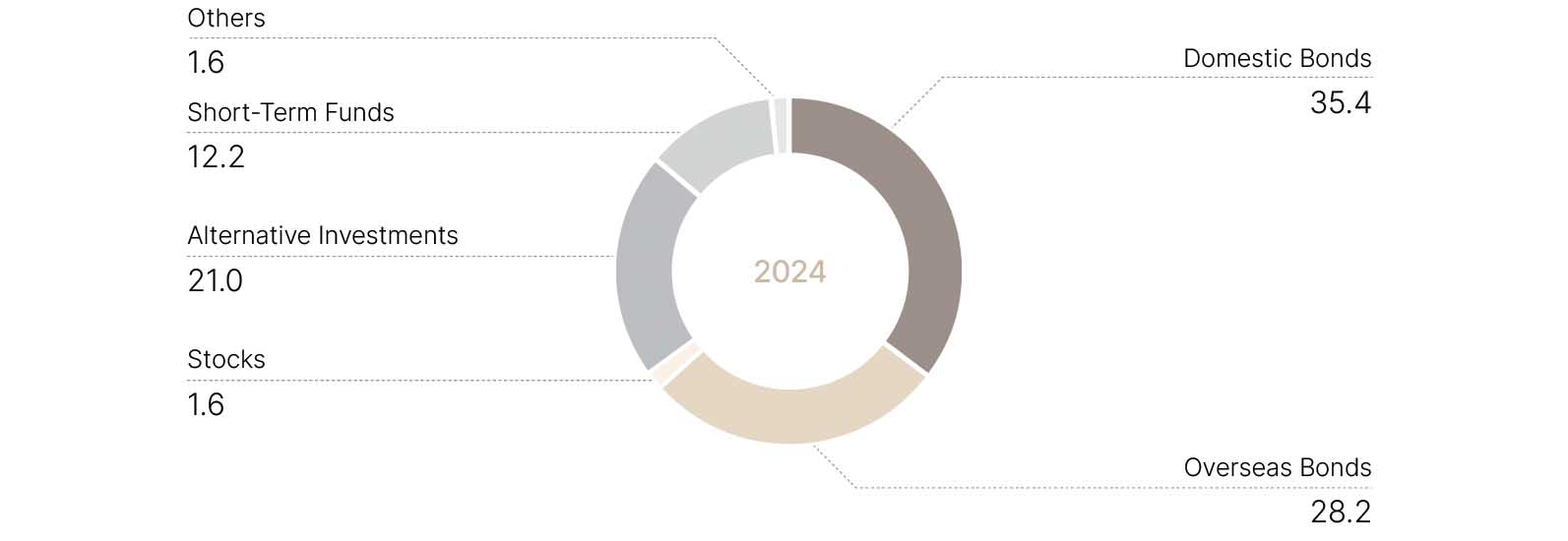

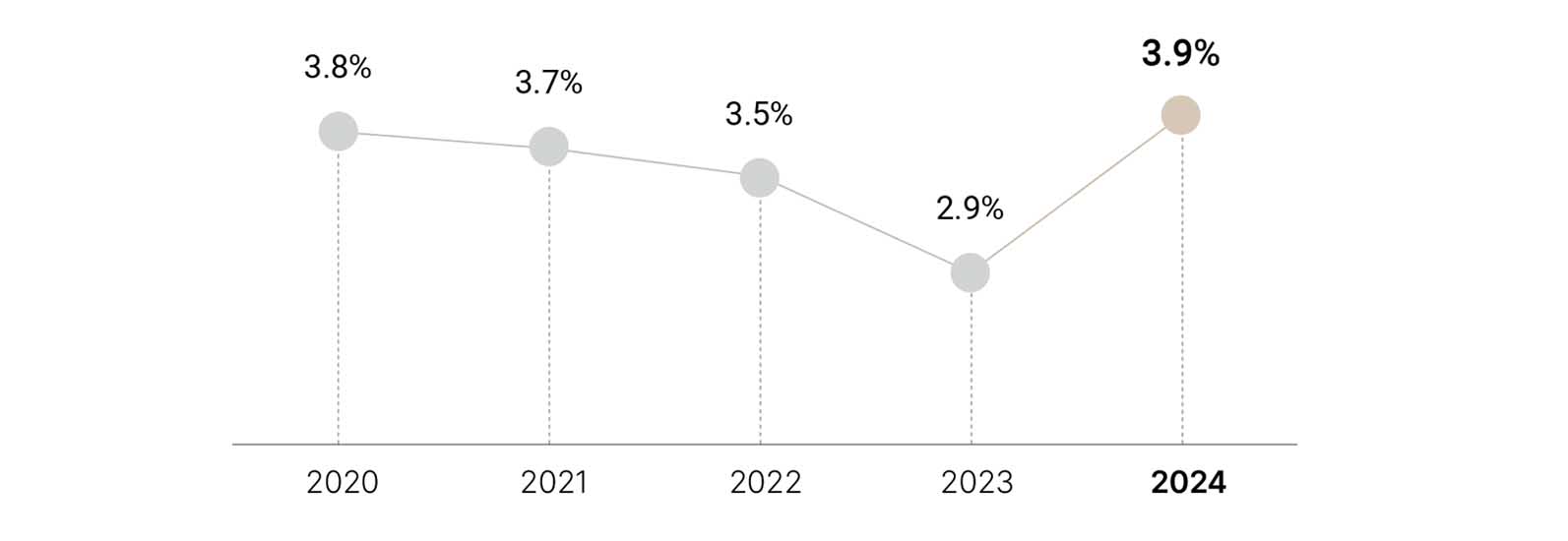

We delivered remarkable investment results with an investment yield of 3.9%, backed by a significant increase in invested assets and a higher book yield. The growth in invested assets was largely attributed to the 2023 coinsurance transaction, while the rise in book yield resulted from portfolio rebalancing into high-interest bonds. Our investment profit reached KRW 389.3 billion, excluding the insurance finance result and gains or losses from foreign exchange hedging for insurance liabilities.

Taking advantage of the high-interest rate environment, we strategically increased our holdings of long-term government bonds to lock in higher yields and enhance portfolio returns. Meanwhile, we adjusted our strategy by reducing allocations to alternative investments and equities, taking into account risks associated with a potential economic downturn and external political uncertainties.

Looking ahead to 2025, our investment strategy will focus on preserving investment returns and maintaining the book yield based on expectations of a gradual decline in interest rates and a subdued economic outlook. In addition, we aim to improve the quality of our alternative investment portfolio and gradually increase overseas exposure.

Given the ongoing risks related to domestic real estate project financing (PF) and overseas commercial real estate, concerns over financial market uncertainty remain high.

In response, we will proactively manage our financial soundness and closely monitor financial market stability to preemptively deal with potential risks.

We will also respond proactively to major regulatory changes to ensure stable investment results, leveraging the strength of our investment portfolio. At the same time, we will continue to explore new investment opportunities and strategies to maximize overall profitability throughout the year.

█ Investment Income

(Unit: KRW billion)

* Excluding gain/losses from foreign exchange and interest rate hedging for insurance liabilities for 2020 – 2024 and the insurance finance result for 2023 and 2024

█ Investment Portfolio Mix in 2024

(Unit: %)

█ Investment Yield

* Excluding gain/losses from foreign exchange and interest rate hedging for insurance liabilities for 2020 – 2024 and the insurance finance result for 2023 and 2024

** The investment yield for 2023 and 2024 is based on IFRS 9, while the rest are based on IAS 39.

Liquidity

Korean Re has maintained sufficient liquidity to meet all financial requirements in both stable and uncertain conditions. In 2024, our liquidity ratio declined from 293.3% to 254.7%, yet it remains at a solid and stable level.

While there was a sharp increase in liquidity ratio in 2023 due to the expanded recognition of liquid assets under the revised regulatory framework, we focused on purchasing medium- to long-term bonds, particularly long-term government bonds, to enhance our investment profitability in 2024. As a result, our liquid assets decreased by 17.8% (KRW 716.9 billion) compared to the previous year-end figure, while the average insurance claims also decreased by 5.4% (KRW 73.5 billion).

To ensure an adequate liquidity ratio, we also operate and maintain bank overdrafts to prepare for events that may deteriorate liquidity, such as losses from alternative investments and large-scale insurance claims. The size of our bank overdrafts stood at KRW 150 billion as of 2024.

Additionally, we took measures to enhance the management of our foreign currency liquidity, including that of our overseas branches. As part of these efforts, we introduced foreign currency money market fund (MMF) transactions to ensure a more efficient and stable liquidity management system.

█ Liquidity Ratio

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Liquid Assets (A) 1) | 3,307.70 | 2,228.30 | 4,024.6 | 3,091.1 |

| Average Insurance Payments (B) 2) | 1,298.50 | 874.80 | 1,372.0 | 1,053.8 |

| Liquidity Ratio (A/B) | 254.7% | 293.3% | ||

1) Liquid assets (A): current assets with remaining maturities of 3 months or less

2) Average insurance payments (B): average insurance payments over 3 months

█ Liquidity Ratio

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Liquid Assets (A) 1) |

3,307.70 |

2,228.30 |

4,024.6 |

3,091.1 |

Average Insurance Payments (B) 2) |

1,298.50 |

874.80 |

1,372.0 |

1,053.8 |

Liquidity Ratio (A/B) |

254.7% |

293.3% |

||

1) Liquid assets (A): current assets with remaining maturities of 3 months or less

2) Average insurance payments (B): average insurance payments over 3 months

Capital Strength

Korean Re always aims to optimize its capital structure and hold sufficient capital in excess of solvency requirements, generating a strong solvency margin ratio (or K-ICS ratio). In 2024, our K-ICS ratio increased by 8.5%p to 191.7% compared to the previous year thanks to our stable net income growth and effective ALM management.

Despite the switching of the solvency margin ratio system from the RBC regime to the K-ICS regime in 2023, as well as the associated increase in confidence levels related to capital requirements measurement, we have maintained a robust K-ICS ratio, demonstrating our financial health.

After the successful issuance of hybrid capital securities in 2014 and completing its redemption by successfully refinancing in the Korean capital market in 2019, Korean Re maintained efficient capital management by issuing new hybrid capital securities in line with the requirements of regulatory authorities and expectations of credit rating agencies. This has enabled us to maintain a sound solvency margin ratio and to further strengthen our balance sheet with an A (Positive) rating by S&P Global Ratings. Utilizing the buffer on the capital, we have been able to increase the level of retention on profitable domestic risks.

█ Hybrid Capital Securities

(Unit: KRW billion)

| Issue date | Coupon | 2024 | 2023 | |

| 2nd issuance | Oct. 21, 2019 | 3.40% | – | 230 |

| 3rd issuance | May 30, 2022 | 4.90% | 230 | 230 |

| 4th issuance | Oct. 28, 2022 | 6.70% | 100 | 100 |

| 5th issuance | Mar. 16, 2023 | 5.50% | 250 | 250 |

| 6th issuance | Oct. 11, 2024 | 4.27% | 230 | – |

| Total | 810 | 810 | ||

█ Hybrid Capital Securities

(Unit: KRW billion)

Issue date |

Coupon |

2024 |

2023 |

|

2nd issuance |

Oct. 21, 2019 |

3.40% |

– |

230 |

3rd issuance |

May 30, 2022 |

4.90% |

230 |

230 |

4th issuance |

Oct. 28, 2022 |

6.70% |

100 |

100 |

5th issuance |

Mar. 16, 2023 |

5.50% |

250 |

250 |

6th issuance |

Oct. 11, 2024 |

4.27% |

230 |

– |

Total |

810 |

810 |

||

█ Solvency Margin Ratio

| 2024 | 2023 | YoY Change | |

| Solvency Margin Ratio (K-ICS Ratio*) |

191.7% |

183.2% | 8.5%p |

* The ratio refers to the solvency margin ratio under the Korean Insurance Capital Standard (K-ICS).

█ Solvency Margin Ratio

2024 |

2023 |

YoY Change |

|

Solvency Margin Ratio

|

191.7% |

183.2% |

8.5%p |

* The ratio refers to the solvency margin ratio under the Korean Insurance Capital Standard (K-ICS).

We completed redemption of the 2nd hybrid capital securities issued in 2019 by refinancing them in 2024. In the long term, we are pursuing organic growth of capital from consistently solid net income results and CAT reserve accumulation.

We will continue to implement prudent capital management measures in ways that enable us to take advantage of favorable market conditions and increase our reinsurance business acceptance as well as to maintain a strong capital position under the IFRS 17/K-ICS regimes.

Credit Ratings

Korean Re has maintained high credit ratings from both S&P Global Ratings and AM Best. The financial strength of a reinsurer is one of the most critical factors for primary insurers in selecting their reinsurance counterparties. We have been striving to remain financially strong, backed by sound risk-based capitalization and stable earnings.

In February 2024, S&P Global Ratings affirmed Korean Re’s Financial Strength Ratings at A but revised its outlooks to Positive from Stable, reflecting its improved view on the company’s capital and earnings. This outlook revision highlights a greater level of risk diversification and increased visibility on our future profits under IFRS 17. The credit rating agency said in its rating report, “The positive rating outlook reflects our expectation that Korean Re will continue to build a record of very strong capital adequacy, while maintaining its dominant position in the domestic reinsurance market over the next 12-18 months.”

It is also expected that Korean Re’s capitalization will be supported by the company’s stable and sound profitability as it leverages its very strong competitive position, according to the statement by S&P Global Ratings.

In December 2024, AM Best upgraded the Long-Term Issuer Credit Rating (Long-Term ICR) to a+ (Excellent) from a (Excellent) and affirmed Korean Re’s Financial Strength Rating (FSR) of A (Excellent). In addition, the rating agency revised the outlook of the Long-Term ICR to Stable from Positive while maintaining a Stable outlook for the FSR. The ratings reflect Korean Re’s balance sheet strength, which AM Best assesses as very strong, as well as its adequate operating performance, favorable business profile, and appropriate enterprise risk management.

According to AM Best, the upgrade of the Long-Term ICR reflects Korean Re’s improved balance sheet strength, underpinned by its risk-adjusted capitalization that showed a noticeable rise in 2023, and is expected to remain at a similar level over the medium term, as measured by Best’s Capital Adequacy Ratio (BCAR). The improvement was driven by increased available capital from hybrid bond issuance in 2023, continued solid profit retention, as well as reduced underwriting risk following the restructuring of the company’s business portfolio. The ongoing efforts to offload unprofitable business are expected to contain the increase in underwriting risk in the foreseeable future and benefit Korean Re with organic growth in retained earnings over the long term. At the same time, the company has demonstrated well-matched asset and liability management, which indicates its capability to maintain a stable solvency ratio and withstand interest rate fluctuations. Other supportive balance sheet strength considerations are good accessibility to capital markets and a conservative investment strategy.

█ Credit Ratings of Korean Re

| Rating Agency | Ratings Details | |

| S&P Global Ratings | Financial Strength Rating Local Currency | A /Positive |

| Issuer Credit Rating | A /Positive | |

| AM Best | Financial Strength Rating | A (Excellent) / Stable |

| Long-Term Issuer Credit Rating | a+ (Excellent) / Positive | |

(As of December 2024)

█ Credit Ratings of Korean Re

Rating Agency |

Ratings Details |

|

S&P Global Ratings |

Financial Strength Rating Local Currency |

A /Positive |

Issuer Credit Rating |

A /Positive |

|

AM Best |

Financial Strength Rating |

A (Excellent) / Stable |

Long-Term Issuer Credit Rating |

a+ (Excellent) / Positive |

|

(As of December 2024)

█ Credit Ratings of Korean Reinsurance Switzerland AG

| Rating Agency | Ratings Details | |

| S&P Global Ratings | Financial Strength Rating Local Currency | A /Positive |

| Issuer Credit Rating Local Currency | A /Positive | |

(As of December 2024)

█ Credit Ratings of Korean Reinsurance Switzerland AG

Rating Agency |

Ratings Details |

|

S&P Global Ratings |

Financial Strength Rating Local Currency |

A /Positive |

Issuer Credit Rating Local Currency |

A /Positive |

|

(As of December 2024)

Dividend and Stock Price Performance

Distributions to Shareholders

Korean Re has a long history of returning value to shareholders based on its consistent dividend policy to offer attractive and sustainable returns to shareholders. Its total dividend payout amount increased by KRW 11.5 billion to KRW 91.0 billion in 2024 due to higher net income, with the payout ratio being maintained at a similar level of 28.7%.

Considering the possible volatility of business results in the initial period of the IFRS 17 implementation, we intended to avoid excessive dividends that could impair our financial strength. The dividend payout ratio will continue to remain at a stable level under the new financial reporting regime.

█ Dividend Performance

2020 |

2021 |

2022 |

2023 |

2024 |

|

Total Dividend Amount (KRW billion) |

46.0 |

53.7 |

52.8 |

79.5 |

91.0 |

Payout Ratio (%)* |

32.4 |

35.0 |

33.4 |

28.0 |

28.7 |

Dividend per Share (KRW) |

450 |

525 |

430 |

540 |

515 |

Dividend Yield (%) |

5.2 |

5.5 |

5.9 |

6.8 |

6.3 |

* The payout ratios for 2020 – 2022 are based on IFRS 4, while the 2023-2024 ratios are based on IFRS 17.

█ Dividend Performance

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Total Dividend Amount (KRW billion) | 46.0 | 53.7 | 52.8 | 79.5 | 91.0 |

| Payout Ratio (%)* | 32.4 | 35.0 | 33.4 | 28.0 | 28.7 |

| Dividend per Share (KRW) | 450 | 525 | 430 | 540 | 515 |

| Dividend Yield (%) | 5.2 | 5.5 | 5.9 | 6.8 | 6.3 |

* The payout ratios for 2020 – 2022 are based on IFRS 4, while the 2023-2024 ratios are based on IFRS 17.

Stock Price Performance

In 2024, South Korea’s stock market experienced a notable downturn, with the Korean Composite Stock Price Index (KOSPI) declining by nearly 10% over the year. One of the key factors behind this decline was domestic political turmoil. In December 2024, President Yoon declared martial law amid political disputes, a move that was swiftly overturned by Parliament. This event led to heightened investor concerns, resulting in a sharp decline in both the stock market and the value of the Korean won.

Economic challenges also played a part in the bearish stock market. Korea’s export-driven economy faced headwinds, particularly with a slowdown in the semiconductor industry—a critical sector for the economy.

In response to these challenges, the Korean government introduced the Corporate Value-Up Program in February 2024, aimed at enhancing market quality and competitiveness. However, the stock market, in general, fell short of expectations, as evidenced by the continued dip in KOSPI.

Despite the broader market downturn, the insurance sector saw strong growth. The KODEX Insurance ETF surged by 22.7%, mainly driven by expectations that insurers would be actively participating in the Corporate Value-Up Program. In terms of market capitalization, the insurance sector soared by 25.2%, with life insurers rising by 27.4% and non-life insurers by 23.6%.

Korean Re’s share price increased by 31.0% from KRW 6,068 (adjusted for bonus issues) at the end of 2023 to KRW 7,950 (adjusted for bonus issues) at the end of 2024. This extraordinary stock performance significantly enhanced our shareholder value for the year.

Market analysts remain highly optimistic about Korean Re, echoing market sentiment from the previous year. Although the global reinsurance market showed signs of softening during the January 1, 2025 renewals, the cumulative rate increases in past years have kept overall reinsurance pricing at a high level.

It is also worth noting that the company stands to benefit from steady growth in invested assets driven by coinsurance transactions and stable investment returns, supported by a strategic swap of lower-yielding bonds for higher-yielding ones in 2023 and 2024.

Over the past year, we delivered strong net income, reflecting our long-standing focus on prudent underwriting. Our efforts to strengthen risk management and reorganize our portfolio resulted in sustained growth in profitability. We also strategically capitalized on hard market conditions following frequent major natural disasters to deliver strong results.

As of year-end 2024, Korean Re’s stock remains undervalued, with a price-to-book ratio (PBR) of 0.45 or lower. From a valuation perspective, this presents an attractive investment opportunity, further reinforcing the positive outlook for the company.

Other Matters Necessary for Investors

Regarding Significant Accounting Policies and Estimates

We prepared financial statements in accordance with the accounting standards adopted by Korea, which are based on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), as specified in Article 5(1)1 of the Act on External Audit of Stock Companies.

For details regarding the significant accounting policies applied in the preparation of the financial statements, please refer to the Notes to the Consolidated Financial Statements for 2024, particularly sections “2. Basis of Preparation and Significant Accounting Policies” and “3. Significant Accounting Judgments, Estimates, and Assumptions.”

Regarding Matters Concerning Employees

Our company operates welfare programs such as financing support for the housing purposes, education assistance, and medical support systems to enhance the well-being and job stability of employees. Furthermore, we manage the risks associated with the turnover of key personnel and strengthen organizational competitiveness by incorporating various educational opportunities and individualized professional career management into our human resources administration. As a reinsurance specialist company, we strive to maintain the highest level of technical expertise and secure specialized personnel to support this endeavor.

Regarding Legal and Regulatory Factors

While regulatory amendments aimed at enhancing the capital strength of insurers and internal controls are underway, there are no specific regulations scheduled for the next fiscal year that are anticipated to significantly impact our business operations.

Outlook

Economic Outlook

Global growth is projected at 3.3% in both 2025 and 2026, below the historical average of 3.7% (2000–2019), according to the International Monetary Fund (IMF). The 2025 forecast remains largely unchanged from the October 2024 World Economic Outlook (WEO), as an upward revision for the United States offsets downward revisions in other major economies.

Global headline inflation is expected to decrease to 4.2% in 2025 and further to 3.5% in 2026, with advanced economies reaching their inflation targets sooner than emerging markets and developing economies.

Medium-term risks to the global economic outlook are tilted to the downside, while near-term risks remain mixed. In the short term, the United States may see stronger-than-expected growth, whereas other major economies face downside risks due to elevated policy uncertainty.

Potential policy-driven disruptions to the ongoing disinflation process could delay monetary policy easing, affecting fiscal sustainability and financial stability. Managing these risks requires a careful balance between inflation control and real economic activity. It is also important to seek stronger medium-term growth through structural reforms and enhanced multilateral cooperation.

█ World Economic Outlook

Real GDP Growth (%) |

Estimate |

Projections |

|

2024 |

2025 |

2026 |

|

World |

3.2 |

3.3 |

3.3 |

Advanced Economies |

1.7 |

1.9 |

1.8 |

United States |

2.8 |

2.7 |

2.1 |

Euro Area |

0.8 |

1.0 |

1.4 |

Germany |

-0.2 |

0.3 |

1.1 |

France |

1.1 |

0.8 |

1.1 |

Italy |

0.6 |

0.7 |

0.9 |

Spain |

3.1 |

2.3 |

1.8 |

Japan |

-0.2 |

1.1 |

0.8 |

Korea |

2.2 |

2.0 |

2.1 |

United Kingdom |

0.9 |

1.6 |

1.5 |

Emerging Market and Developing Economies |

4.2 |

4.2 |

4.3 |

China |

4.8 |

4.6 |

4.5 |

India |

6.5 |

6.5 |

6.5 |

Russia |

3.8 |

1.4 |

1.2 |

Brazil |

3.7 |

2.2 |

2.2 |

Saudi Arabia |

1.4 |

3.3 |

4.1 |

* For India, data and projections are presented on a fiscal year basis, with FY 2024/25 (starting in April 2024) shown in the 2024 column. India’s growth projections are 6.8% for 2025 and 6.5% for 2026 based on the calendar year.

(Source: IMF, World Economic Outlook Update, January 2025)

█ World Economic Outlook

| Real GDP Growth (%) | Estimate | Projections | |

| 2024 | 2025 | 2026 | |

| World | 3.2 | 3.3 | 3.3 |

| Advanced Economies | 1.7 | 1.9 | 1.8 |

| United States | 2.8 | 2.7 | 2.1 |

| Euro Area | 0.8 | 1.0 | 1.4 |

| Germany | -0.2 | 0.3 | 1.1 |

| France | 1.1 | 0.8 | 1.1 |

| Italy | 0.6 | 0.7 | 0.9 |

| Spain | 3.1 | 2.3 | 1.8 |

| Japan | -0.2 | 1.1 | 0.8 |

| Korea | 2.2 | 2.0 | 2.1 |

| United Kingdom | 0.9 | 1.6 | 1.5 |

| Emerging Market and Developing Economies | 4.2 | 4.2 | 4.3 |

| China | 4.8 | 4.6 | 4.5 |

| India | 6.5 | 6.5 | 6.5 |

| Russia | 3.8 | 1.4 | 1.2 |

| Brazil | 3.7 | 2.2 | 2.2 |

| Saudi Arabia | 1.4 | 3.3 | 4.1 |

* For India, data and projections are presented on a fiscal year basis, with FY 2024/25 (starting in April 2024) shown in the 2024 column. India’s growth projections are 6.8% for 2025 and 6.5% for 2026 based on the calendar year.

(Source: IMF, World Economic Outlook Update, January 2025)

Insurance Market Outlook

The global primary insurance market is expected to see slower growth in 2025 following robust growth in 2024, as non-life premium rates moderate and life insurance sales stabilize. Still, demand will be supported by steady global economic expansion, resilient labor markets, rising real incomes amid moderating inflation, and higher long-term interest rates.

The primary non-life insurance industry continues to improve its profitability as underwriting results benefit from easing inflation and elevated premium rates, and this strength is expected to continue. Combined with improving investment returns, profitability is likely to remain solid. We also expect the life sector to maintain profitability in the coming year given higher reinvestment yields.

Meanwhile, the reinsurance sector has been strong in terms of profitability and is expected to stay resilient in 2025, even as the pricing cycle has likely peaked. Solid profits in 2023 and 2024 were driven by the most favorable underwriting conditions in over two decades, coupled with steady investment income. The balance-sheet resilience of the reinsurance industry has also been bolstered by strong capital buffers and strengthened reserves. While reinsurers maintain underwriting discipline, capitalization is expected to remain strong, helping reinsurers cope with potential headwinds, including declining prices from recent highs, elevated catastrophe losses, and rising claims costs.

Outlook for Korean Re’s Business in 2025

In 2025, our reinsurance portfolio is projected to grow by approximately 2.5%. This forecast reflects multiple factors, including baseline effects stemming from the previous year’s coinsurance volume, as well as our continuous efforts to restructure our portfolio to enhance profitability. Furthermore, we are committed to actively expanding our portfolio with a focus on sustainable and profitable growth.

We will maintain a profitability-driven portfolio growth initiative by carefully managing retention levels in promising business lines. Despite the transition to a soft market across various business lines and regions, we remain dedicated to strategic business activities that ensure both growth potential and profitability.

Our growth strategy for the 2024-2026 period has been formulated in accordance with the new accounting and solvency regulations (IFRS 17 & K-ICS) to ensure compliance with key financial requirements. Under these regulatory frameworks, we aim to achieve stable net income and maintain an adequate solvency ratio by optimizing our portfolio structure and strengthening our market presence.

Our investment yield expectations remain conservative, with a target yield exceeding 3.6% in 2025. We seek to secure stable investment returns through the appropriate allocation of our diversified investment portfolio.

As of 2024, our overseas business accounted for 42.4% of our total portfolio. Despite ongoing comprehensive portfolio adjustments, we anticipate this share to reach 50% in the medium to long term. By establishing a globally diversified portfolio structure, we aim to maximize the benefits of risk diversification while strategically capitalizing on various opportunities in the global market.

Caution on Forward-Looking Statements

This report contains forward-looking statements, including statements regarding Korean Re’s future operations, strategies, financial condition, and business prospects. These statements are based on current expectations and assumptions and are subject to risks and uncertainties that could cause actual results to differ materially. Korean Re undertakes no obligation to update or revise any forward-looking statements to reflect future events or circumstances.

Risk Management Report

Risk Management Framework

Our risk management framework upholds an efficient and effective risk management environment to support the achievement of the company’s business goals and strategies. The framework sets out how Korean Re defines, manages, monitors, and reports risks based on its risk governance.

Objectives

Korean Re implements enterprise risk management initiatives to achieve a stable set of risk management objectives. The objectives are as follows:

• Continuously enhancing shareholder value

• Maintaining a high level of credibility with stakeholders, credit rating agencies, and supervisory agencies

• Diversifying insurance and investment portfolios, while also enhancing risk management with regard to overseas business growth

Strategic Risk Management

Korean Re’s business strategy is aligned with its risk management strategy and risk appetite. The Risk Appetite Framework provides the main direction to steer the company as it moves forward, with all risks managed under this framework. Based on the capital plan and financial targets linked to our risk appetite, we establish business plans and operate the business in a stable manner by monitoring and evaluating business performance according to risk indicators.

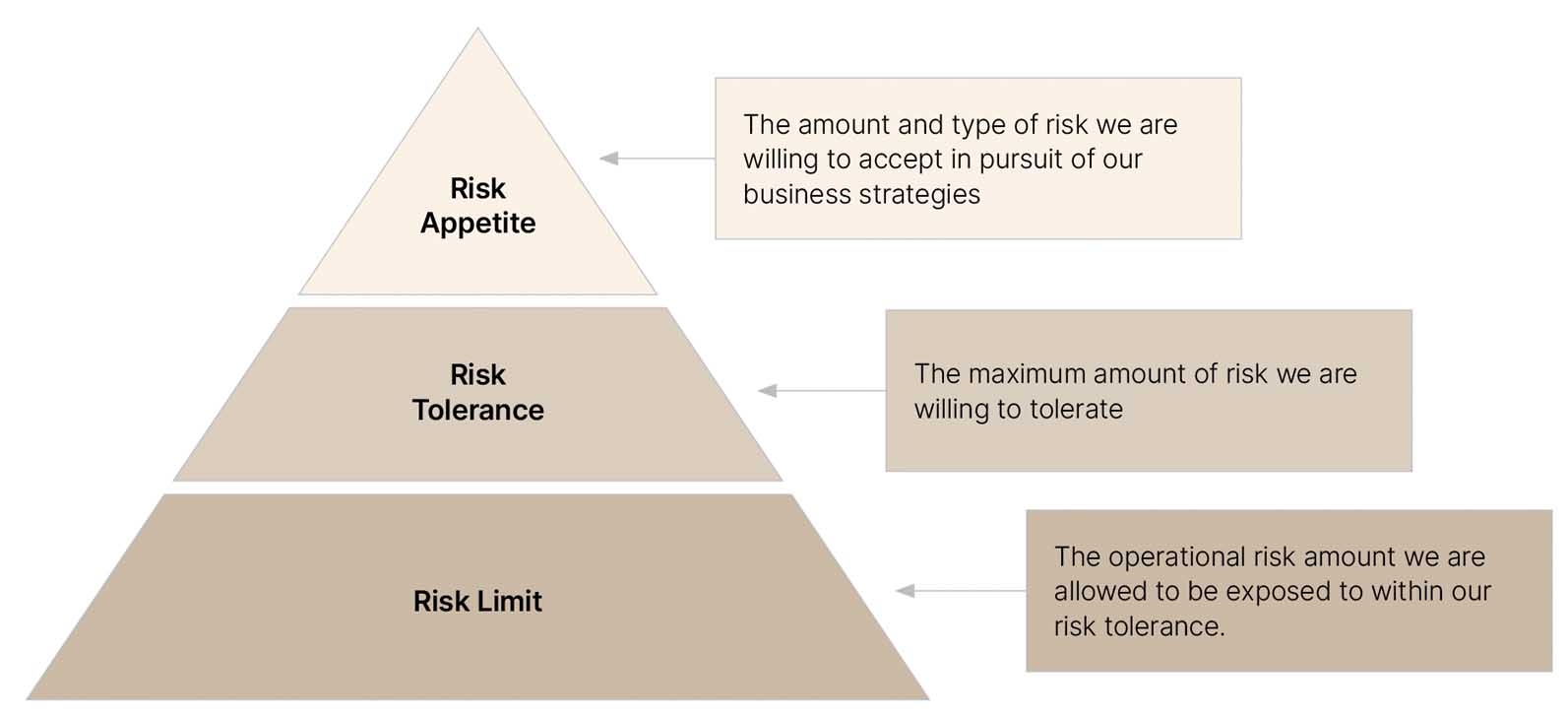

Risk Appetite Framework

Korean Re’s risk appetite framework is an enterprise-wide risk management guideline made up of three important components: risk appetite, risk tolerance, and risk limit.

Risk appetite defines the amount of risk we should accept in consideration of the company’s vision and business objectives. The risk appetite statement is as follows:

• Maintain the solvency ratio within an optimal range (160%-200%)

• Focus on our comparative advantage businesses and achieve a target ROE

• Maintain a conservative risk management policy, with risks being retained at a medium-low level considering our capital

• Improve capital efficiency by optimizing our insurance and investment portfolios

• Continue to improve our risk-adjusted return on capital (RAROC)

Risk appetite plays a significant role in maintaining our risk profile within the boundaries defined by different objectives, such as profitability, solvency, growth, and liquidity. Risk appetite also provides a solid foundation for decision-making with regard to strategic asset allocation, capital planning, portfolio management, and more.

Risk tolerance represents a quantitative level of risk acceptance within the risk appetite and helps create macro guidelines for capital adequacy, liquidity, and concentration. The risk tolerance statement is as follows:

• Maintain the solvency ratio within a stable range (above 150%)

• Maintain a credit rating of A or above

• Ability to meet day-to-day financial obligations (liquidity)

Risk limit describes the risk capacity constraints determined by capital and liquidity resources to ensure compliance with our risk appetite and risk tolerance.

█ Risk Appetite Framework

Capital Management

Korean Re’s capital is managed through a framework which provides a robust foundation for capital management. To ensure Korean Re’s sound capital management, we align our risk management strategy with our long-term business strategy. Strategic objectives are examined from the perspective of our risk management strategy to be certain if they are in accordance with our risk appetite, and the results are then reflected in our business plans. We also have a detailed capital management plan in place based on the levels of solvency ratio in order to maintain the optimal range of solvency. Korean Re’s capital management framework is comprised of three main modules: capital planning, business planning, and risk planning. Each module is structured to ensure full compliance with Korean Re’s risk appetite and tolerance.

Portfolio Optimization

Korean Re performs business planning by analyzing the risks and profitability of its businesses. We measure return on risk-adjusted capital (RORAC) for each line of our insurance business and investment asset portfolio through our own internal model. Based on this, the Strategic Planning office draws up plans for optimal portfolios and then finalizes annual plans that can achieve capital efficiency with respect to risk appetite and improve our RORAC.

Risk Governance

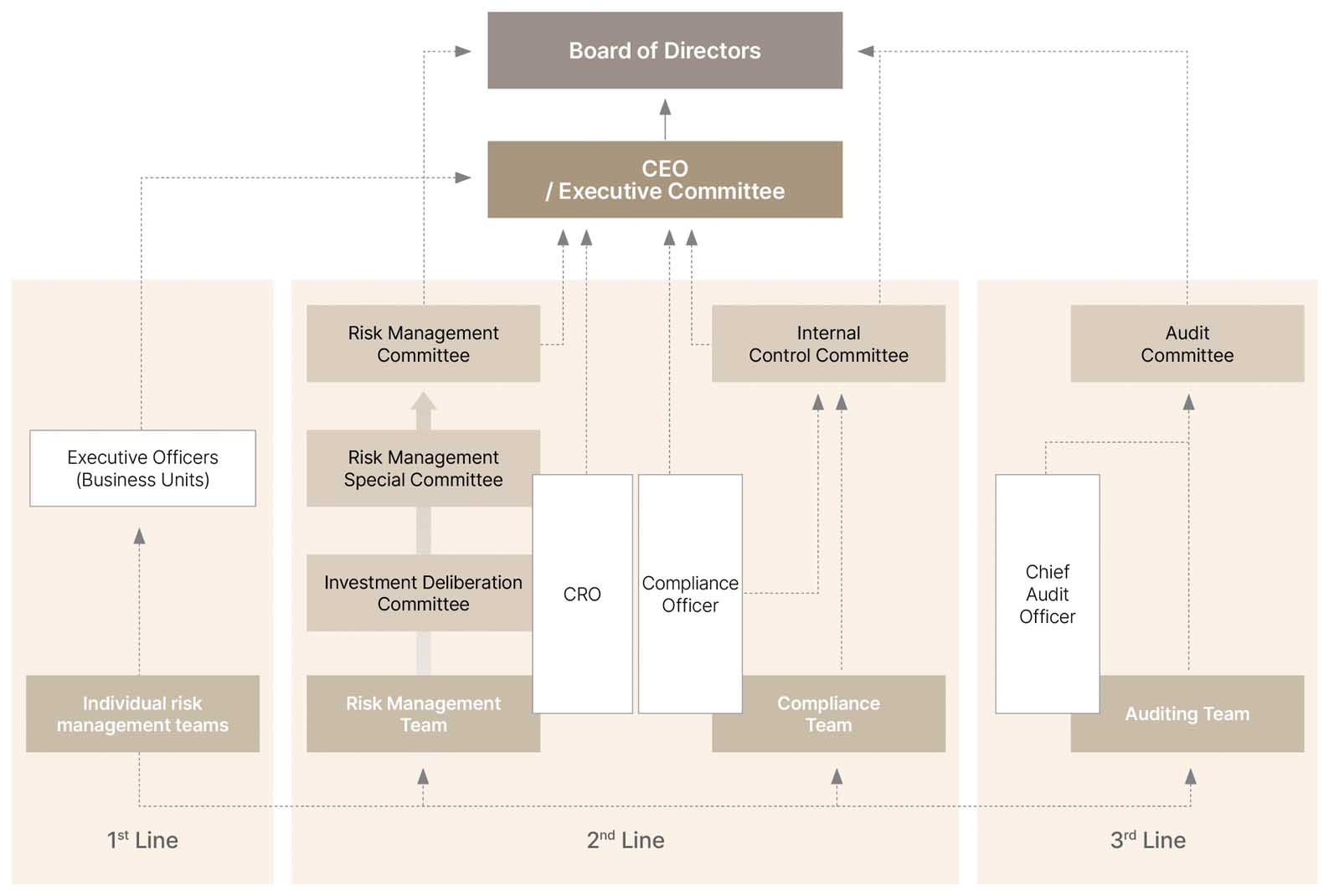

Korean Re has built a comprehensive framework for risk governance based on central oversight and controls of risks with clear accountability. This structure supports risk-based decision-making and oversight across all operations of our businesses. Risk governance defines the roles and responsibilities of the Board of Directors, committees, management structures, and related teams. It also involves the implementation of three lines of defense as part of the structure.

The Three Lines of Defense model that we implement demonstrates our risk governance, laying out the roles of business and oversight organizations in managing our risk profile. The first line of defense includes front-line managers and staff who are responsible for day-to-day risk management and decision-making. (Overseas office staff are also a first line of defense.) Their primary responsibility is to maintain an effective control environment and ensure that all activities are within our risk appetite. The second line of defense deals with setting risk policies and overseeing our risk management status. This involves the Risk Management Team, the Chief Risk Officer (CRO), the Risk Management Committee (RMC), the Risk Management Special Committee (RMSC), the Investment Deliberation Committee, and compliance functions, that is, the Compliance Team, the Compliance Officer, and the Internal Control Committee. The third line of defense provides independent assurance through an internal audit and validates the effectiveness of the first and second lines of defense in fulfilling their responsibilities and managing our risk profile.

█ Three Lines of Defense

Risk Landscape of Korean Re

In the course of its business operations, Korean Re is confronted with a wide range of risks. These risks are consciously embraced, guided, and monitored in line with the actions taken toward the corresponding opportunities. The Board of Management’s parameters and decisions regarding Korean Re’s risk appetite, which are grounded in risk-bearing capacity calculations, are essential for risk acceptance. In this regard, our risk management plays a pivotal role in ensuring that risks to the reinsurance portfolio remain measurable and that even extraordinary major losses do not excessively impact the outcome.

█ Risk Landscape of Korean Re

Key Risks

We manage five key risks— insurance risk, financial risk (credit & market), liquidity risk, emerging risk, and operational risk (which includes strategy, reputation, regulation and legal risks)—all of which are likely to have a significant impact on our financial results and/or operational viability. In doing so, we implement a series of procedures that include risk identification, measurement, control, analysis, and reporting.

Insurance Risk

Korean Re defines insurance risk as the risk of unexpected financial losses arising from the inadequacy of premiums or reserves for natural catastrophe or non-catastrophe events, or from the unpredictability of biometric risks, such as the mortality rate.

We manage insurance risks in a consistent manner across the company by assessing and monitoring them in accordance with clearly defined underwriting guidelines.

Furthermore, we utilize a natural catastrophe modeling program and an accumulation management system to effectively control catastrophe risk at the corporate level.

Market Risk

Korean Re defines market risk as the risk of losses arising from fluctuations of the value of assets and liabilities due to changes in relevant factors, such as interest rates, stock prices, and foreign exchange rates. We manage this risk in our day-to-day operations and, more specifically, hedge against foreign exchange risk using derivatives in order to keep our exposure at a safe level.

At the same time, we closely monitor global economic and financial market conditions and outlooks that can affect our investment performance in order to analyze their potential impact and come up with effective countermeasures.

Credit Risk

Our credit risk system focuses on any losses arising from the failure of the counterparty to a reinsurance contract to meet its contractual obligations or from deterioration in the credit quality of invested assets.

We conduct an analysis of potential losses before making any high-risk business decisions, including whether to write new business contracts or invest in derivatives. When necessary, these decisions are made through the review process of the Risk Management Special Committee and the Investment Deliberation Committee. Identifying any abnormal signs related to retained risks is also an essential element of our preemptive risk management system.

Liquidity Risk

We plan and manage our liquidity positions in order to deal with future claims payments and expenses as they arise. To this end, we set liquidity limits based on our future cash flow, and then monitor them regularly.

Generally, our liquidity is managed based on short-term and mid-term working capital management plans by the Accounting Team and Investment Strategy & Operations Team. On this basis, we regularly monitor the liquidity status of the company.

We also manage liquidity risk through the regulatory liquidity ratio and S&P liquidity ratio to meet short-term and future payment obligations. Specifically, we establish our tolerance and limit based on our S&P liquidity ratio, which is measured by dividing stressed liquid assets by stressed insurance liability outflows. We set and manage the minimum liquid asset level on an ongoing basis to meet our daily business obligations, settlements, and expenses in a normal situation.

Operational Risk

Korean Re defines operational risk as the risk of potential losses arising from inadequate or failed internal processes or systems or human errors, and/or from external events. We have identified a set of operational risks that cover various business units and activities, including strategy, reputation, new product development, and claims management.

We manage these risks through effective policies and procedures that have a clear separation of duties, timely internal controls, and reporting systems. Through the internal control system, operational risks are managed systemically based on our Code of Conduct and other internal regulations.

Emerging Risk

Emerging risks are defined as types of risks that were either not recognized or not considered of significant interest in the past but have started to gain attention.

Our approach to managing emerging risks involves a comprehensive analysis, and each team establishes management strategies for their respective risks based on a detailed analysis report on potential emerging risks.

The emerging risks that we have selected for 2025 are as follows:

• Geopolitical Conflicts and Clashes

· The escalation of armed conflicts may lead to large-scale migration and a concentration of risks in specific regions.

· Maritime disputes can result in increased marine insurance premiums and transportation costs.

· Rising tensions may cause asset losses due to strikes, riots, and civil commotions (SRCC) and also impact business interruption losses.

• Damage to Social Infrastructure Systems due to Increased Natural Disasters

· The combined impact of disasters and the interconnectivity between major infrastructure and supply chains can lead to an accumulation of losses.

· If critical infrastructure such as power transmission lines and power plants is damaged by natural disasters, claims may arise under Property Insurance and Business Interruption Insurance.

· Facilities that rely on continuous power supply, such as hospitals, data centers, and security systems, may suffer cascading damages.

By proactively identifying and addressing these emerging risks, we aim to enhance our resilience and ensure the effectiveness of our risk management strategies. These efforts align with our commitment to staying ahead of evolving challenges and safeguarding the interests of our stakeholders.