Note: This section covers business results for the head office only, with gross written premiums used to measure business volume and the combined ratio calculated under IFRS 4.

Domestic Property & Casualty (P&C)

Property

The Korean property insurance market experienced modest growth in 2024, with stable premium increases and favorable loss trends. The loss ratio of the market stood at 55.4% as of November 2024, primarily due to fewer natural disasters and a reduction in large losses. Gross written premiums rose by 2.9% year over year to KRW 2,670 billion. By line of business, the fire insurance market grew by 8.4%, reaching KRW 314 billion in premium income, while the comprehensive insurance market saw a 2.2% year-over-year increase, totaling KRW 2,356 billion as of November 2024.

Treaty Business

We operate private treaties with 16 ceding insurers, and our premium income from these treaties increased by 6.8% to KRW 180 billion. Our domestic property treaty business consists of approximately 95% tariff rate-based contracts and 5% Korean Re rate-based contracts.

Since UY2023, we have continuously strengthened our underwriting review during treaty renewals. To mitigate adverse selection by ceding insurers, we have renewed variable quota share (Q/S) treaties with a narrower cession range. Additionally, we remain committed to structural improvements, including lowering treaty commission rates and imposing a loss participation clause (LPC) to enhance profitability.

Building on our stable performance in 2024, we have continued to ensure treaty profitability by maintaining strict underwriting discipline and resisting pressure to loosen treaty terms and conditions (T&Cs) during 2025 renewals. This will help us maintain stability in our business performance in the year ahead.

Facultative Business

Our premium income from the domestic property facultative business increased slightly by 0.6% to KRW 457 billion, as we prioritized selective underwriting and maintained a prudent approach to writing profitable accounts.

Korean Re’s facultative business has been focusing on underwriting mega-sized accounts in a reinsurer-driven market since the widespread adoption of judgment rates in 2019. Mega-sized accounts provide reinsurers with sufficient payback opportunities, as improved policy terms follow large-loss occurrences. As a result, our facultative business currently is comprised of approximately 80% mega-sized accounts, defined as total sum insured (TSI) above KRW 1 trillion, and 20% small and medium-sized (SME) accounts.

On the other hand, SME accounts are characterized by intense rate competition and an insured-driven market. Given these conditions, we strive to selectively underwrite SME accounts that have shown stable performance with adequate premiums.

In 2025, the domestic property insurance market is expected to soften further, driven by improved market performance and an influx of overseas reinsurance capacity. While maintaining a profitability-focused underwriting stance in our facultative business, we will seek growth opportunities through our treaty business, leveraging our established relationships with ceding insurers to secure facultative placements.

█ Gross Written Premiums: Domestic Property

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Treaty | 180.4 | 131.8 | 168.9 | 128.0 |

| Facultative | 456.6 | 333.7 | 454.0 | 344.1 |

| Nuclear Insurance | 8.4 | 6.1 | 7.5 | 5.7 |

| Total | 645.4 | 471.6 | 630.4 | 477.8 |

*Domestic property covers Korean Interest Abroad (KIA), and nuclear insurance includes overseas business.

█ Gross Written Premiums: Domestic Property

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Treaty |

180.4 |

131.8 |

168.9 |

128.0 |

Facultative |

456.6 |

333.7 |

454.0 |

344.1 |

Nuclear Insurance |

8.4 |

6.1 |

7.5 |

5.7 |

Total |

645.4 |

471.6 |

630.4 |

477.8 |

*Domestic property covers Korean Interest Abroad (KIA), and nuclear insurance includes overseas business.

Korea Atomic Energy Insurance Pool (KAEIP)

In Korea, nuclear risks are insured by the Korea Atomic Energy Insurance Pool (KAEIP), which is managed by Korean Re. With 12 member companies, KAEIP is a voluntary, unincorporated association. On behalf of its members, we support the operation of KAEIP based on our expertise in risk management and underwriting so that the pool can provide risk transfer solutions to the nuclear industry that would otherwise be unable to obtain insurance coverage. The pool jointly underwrites domestic and international nuclear risks.

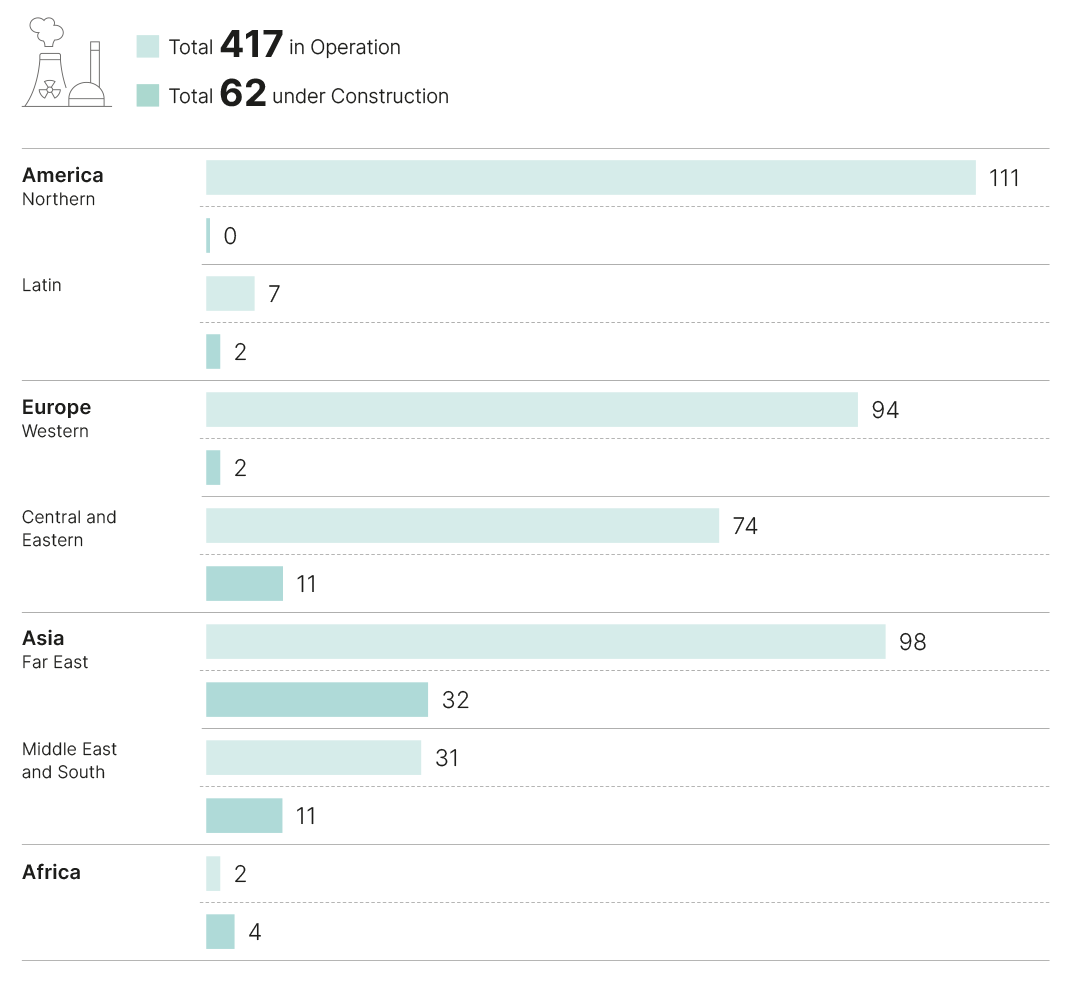

There are 28 nuclear power plants (NPPs) in Korea, with 26 NPPs in operation and two NPPs permanently shut down (Kori Unit 1 in June 2017 and Wolsong Unit 1 in December 2019). At present, four additional units are under construction. Globally, a total of 417 reactors are commercially operational, and 62 reactors are currently being built. Major countries with nuclear reactors under construction include China (28 units), India (7 units), and Turkiye (4 units).

In 2024, KAEIP achieved growth in gross written premiums, which increased by KRW 1.7 billion to KRW 67.5 billion.

The domestic direct business is expected to grow in line with the ongoing construction of nuclear reactors. At the Shin-Hanul site, two units started construction in November 2024. Globally, the premium size is expected to remain stable or see only a slight increase, as the market growth driven by the Revised Paris Convention has already been accounted for in previous years.

As a specialized insurance provider for the nuclear industry, KAEIP remains committed to supporting nuclear operators by offering insurance capacity and risk management services. While maintaining stable insurance capacity domestically, it will also seek new growth opportunities worldwide by adapting to market trends. Korean Re will play a leading role in these efforts, working alongside KAEIP to ensure stable growth of the pool.

█ Gross Written Premiums: Korea Atomic Energy Insurance Pool (KAEIP)

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Domestic Direct | 43.2 | 31.5 | 40.6 | 30.8 |

| Overseas Reinsurance Inward | 24.3 | 17.8 | 25.2 | 19.1 |

| Total | 67.5 | 49.3 | 65.8 | 49.9 |

█ Gross Written Premiums: Korea Atomic Energy Insurance Pool (KAEIP)

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Domestic Direct |

43.2 |

31.5 |

40.6 |

30.8 |

Overseas Reinsurance Inward |

24.3 |

17.8 |

25.2 |

19.1 |

Total |

67.5 |

49.3 |

65.8 |

49.9 |

█ Global Reactor Status by Region

(Source: Power Reactor Information System (PRIS), International Atomic Energy Agency (IAEA), As of February 7, 2025)