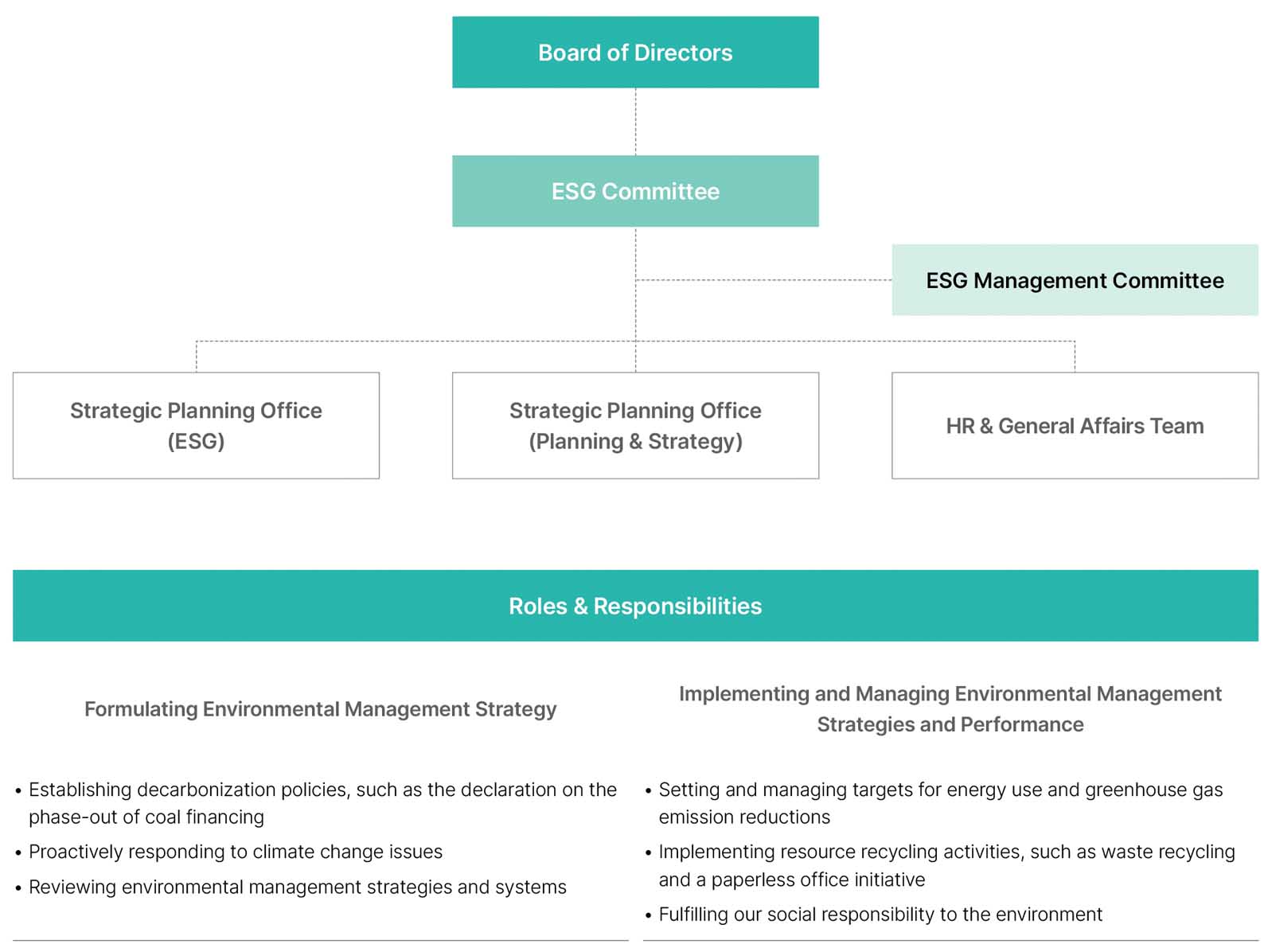

Environmental Management Governance

The Korean Re ESG Committee has been delegated the authority and responsibility for company-wide environmental management by the BOD, the company’s highest decision-making body, which includes the CEO. The committee oversees the formulation and implementation of related strategies, goal setting, and performance management, with support from the ESG Management Committee (a consultative body of managing directors) and dedicated operational teams, such as the Strategic Planning Office and the HR & General Affairs Team.

█ Environmental Management Governance

Environmental Management Governance

The Korean Re ESG Committee has been delegated the authority and responsibility for company-wide environmental management by the BOD, the company’s highest decision-making body, which includes the CEO. The committee oversees the formulation and implementation of related strategies, goal setting, and performance management, with support from the ESG Management Committee (a consultative body of managing directors) and dedicated operational teams, such as the Strategic Planning Office and the HR & General Affairs Team.

█ Environmental Management Governance

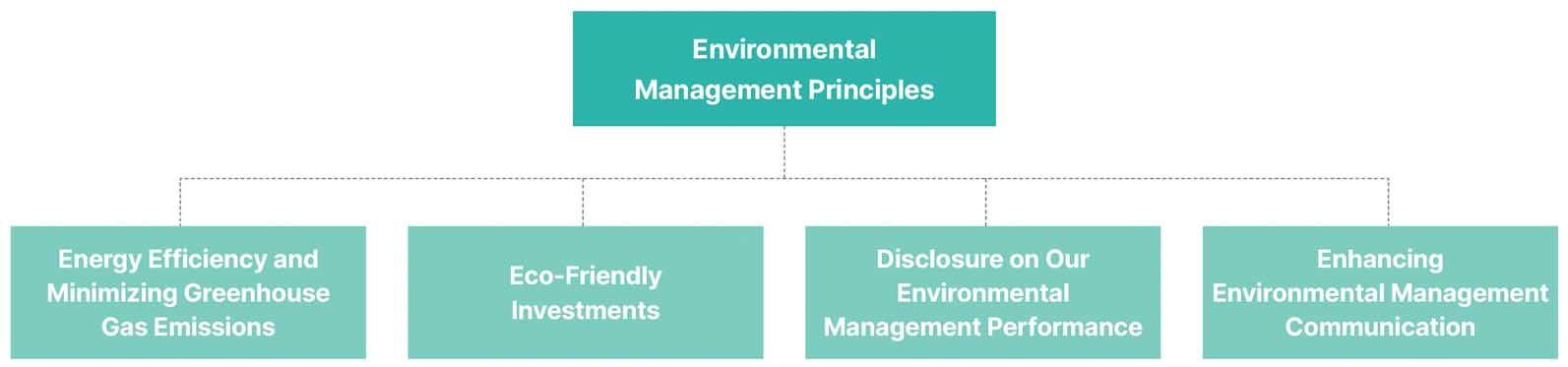

Environmental Management Policy

Korean Re supports the Paris Agreement and recognizes its mission and responsibility as a global reinsurance company to limit the average temperature increase of the earth to 1.5°C or below compared to pre-industrial levels. To ensure responsible environmental management by all employees, including top management, we established our own Environmental Management Declaration and Code of Conduct.

Principles and Objectives

· Fulfillment of responsibilities by mindful and responsive top management and employees

Energy Efficiency

· Monitoring energy use

· Setting targets for reducing greenhouse gas emissions

· Providing regular education to raise environmental management awareness

Eco-Conscious Investments

· Adjusting the portion of high environmental risk assets in the investment portfolio

(i.e., companies that overlook climate risks or are involved in high-emission projects)

Greater Transparency

· Publicly disclosing objective environmental management performance data with third-party assurance

· Joining domestic and international environmental initiatives

Environmental Management Policy

Korean Re supports the Paris Agreement and recognizes its mission and responsibility as a global reinsurance company to limit the average temperature increase of the earth to 1.5°C or below compared to pre-industrial levels. To ensure responsible environmental management by all employees, including top management, we established our own Environmental Management Declaration and Code of Conduct.

Principles and Objectives

· Fulfillment of responsibilities by mindful and responsive top management and employees

Energy Efficiency

· Monitoring energy use

· Setting targets for reducing greenhouse gas emissions

· Providing regular education to raise environmental management awareness

Eco-Conscious Investments

· Adjusting the portion of high environmental risk assets in the investment portfolio

(i.e., companies that overlook climate risks or are involved in high-emission projects)

Greater Transparency

· Publicly disclosing objective environmental management performance data with third-party assurance

· Joining domestic and international environmental initiatives

Declaration on the Phase-Out of Coal Financing

There are increasing demands for responsible investment by financial institutions. For the insurance industry, in particular, underwriting and managing assets with internalized ESG factors are becoming increasingly important.

In November 2022, Korean Re declared its intention to phase out coal financing, following a resolution by the ESG Committee. This initiative aims to contribute to the transition to a carbon-neutral economic system as a global reinsurer and internalize ESG factors across our management practices.

We are committed to achieving net-zero carbon emissions by 2050 through phasing out coal financing and setting eco-friendly underwriting and investment goals.

Responsible Investment Standards

In May 2023, Korean Re established the Responsible Investment Standards to recognize its social responsibility and impact on sustainability and to strengthen its asset management policies related to the coal phase-out declaration and carbon neutrality goals as part of its active participation in the 2015 Paris Agreement. The standards contain a set of principles that should be applied from the stage of the identification and proposal of businesses and projects to the final deliberation and resolution.

ESG Investment Criteria and Process

Korean Re bases its investments on socially responsible investment (SRI*) criteria. We allocate funds raised through the issuance of sustainable bonds to areas with clear ESG advancement objectives, such as renewable energy. In the process of making investment decisions regarding stocks, bonds, and other securities, we prioritize companies demonstrating outstanding ESG performance. Additionally, we strive to reduce the net greenhouse gas emissions from our investment portfolio in line with our 2050 Net-Zero goals.

* Socially Responsible Investment (SRI): A financial activity that invests in companies based on a wide range of performance metrics, including human rights, environment, labor, and community contributions, in addition to financial performance.

Investment Restrictions and Exceptions

Korean Re proactively reviews and restricts investments in companies and industries that negatively impact the environment and society. We gradually limit investments in the following areas, and we regularly update our investment restrictions list for certain listed companies and bond issuers as necessary:

• Coal mining and coal-fired power plant construction

• Tar sands, Arctic, and deep-sea oil and gas

• Other companies and industries deemed not to be in support of social responsibility

However, exceptions may be considered for special purpose bonds and funds that align with ESG objectives or for investments in socially necessary areas, such as national energy policies, support for the socially disadvantaged, and assistance to underdeveloped countries. In such cases, prior coordination with the ESG Manager is required to minimize social and environmental risks associated with any investments.

Climate Risk Management

Accurately assessing disaster risks is crucial for the reinsurance business. Overestimating risks can constrain business operations, while underestimating them can lead to risk management failures. Since the expected damages from natural disasters due to extreme weather and their associated insurance payouts may not increase linearly, precise assessment of climate risks is becoming increasingly important.

In this context, Korean Re puts a priority on ensuring business stability and minimizing losses through accurate climate risk evaluation. We have also implemented a number of different measures to achieve this goal, such as operating catastrophe (CAT) models and expanding research collaborations with academic institutions.

CAT Modeling

To effectively manage catastrophe risk, one of the major physical risks for our company, we have an organizational unit dedicated to CAT modeling that consists of experts in natural disaster risks. This team calculates the precise impact of each risk factor, such as typhoons and earthquakes, and monitors the financial impacts of climate risks to keep them under control within our risk limits. In 2023, we enhanced our extreme event risk management by adopting Moody’s RMS model, which now operates alongside the existing Verisk AIR model.

Moreover, with climate change leading to increased secondary peril damages globally, Korean Re continuously strengthens related risk management through updates to the Hazard Map system and underwriter training.

Industry-Academia Research Collaboration on Climate Risks

In 2022, Korean Re, in collaboration with the Korean Risk Management Society, launched the Climate Risk Management Task Force (TF). This initiative aims to share climate change expertise with academia and the insurance industry through research projects and seminars.

A year later, in 2023, Korean Re formed an interdisciplinary climate risk modeling research group. Consisting of four teams from three universities, the group conducts joint research on climate risk scenario analysis and stress testing methodologies.

Through these industry-academia research collaborations, Korean Re fosters interdisciplinary discussions and disseminates the latest research findings. This effort has established a platform for strategic discussions to address evolving climate risks, positioning Korean Re as a leader in the insurance industry.

■ Climate Risk Management Task Force

Through the operation of the Climate Risk Management Task Force (TF), in collaboration with the Korea Risk Management Society, Korean Re is at the forefront of addressing climate crises by sharing expertise and insights from various fields with academia and the insurance industry.

The TF expands climate crisis research by integrating disciplines such as insurance, climate science, meteorology, and engineering. Today, it continues to support academic studies by providing a platform for emerging researchers.

■ Interdisciplinary Climate Risk Modeling Research Group

Increasing extreme weather events impact economic systems in the form of physical and transitional risks. Therefore, precisely predicting potential climate risks and modeling their financial and insurance impacts is essential to the insurance business. To address this, Korean Re has formed an Interdisciplinary Climate Risk Modeling Research Group in collaboration with leading university researchers. Together, they are developing an integrated climate risk management model that incorporates future climate change impacts into our existing CAT models. This initiative ultimately aims to establish a more advanced climate risk management framework.

The research comprises three stages: climate change scenario development, climate risk quantification, and financial and insurance impact analysis. Each research area is sequentially and interdependently linked. In addition, we have hosted industry-academia research seminars on each of these research stages to share knowledge and discuss response strategies with industry and academic stakeholders.

Environmental Protection and Biodiversity Conservation Activities

Environmental management practices are an integral part of our business activities. Korean Re employees participate in several environmental protection and biodiversity conservation activities. The company encourages employee engagement in these initiatives to raise their eco-consciousness and establish environmental management as a core value shared across the organization.

Korean Re has regularly cleaned up the area around Yongmuchi Beach in Dangjin since adopting it as a partner beach in 2022. In terms of biodiversity conservation activities, we took it upon ourselves to clean up the Yeouido Saetgang Ecological Park. Our employees volunteered their time to throw soil balls containing microorganisms that break down pollutants around the area, helping to improve the river’s water quality. We also removed invasive species, such as Humulus japonicas and Aralia elata, to protect the river area’s ecosystem, while planting spirea plants along the riverbank, thus contributing to urban forestation and air quality improvement.

In 2024, Korean Re employees participated in a “Bee-Friendly Forest” campaign, volunteering to plant nectar-producing trees in urban areas to restore habitats for pollinators, especially bees. This initiative supports biodiversity, strengthens urban ecosystems, and reflects Korean Re’s commitment to environmental sustainability and community involvement.