Treaty Business

In 2024, the reinsurance market navigated a shifting landscape influenced by macroeconomic volatility, climate change-driven catastrophe losses, moderating inflation, and geopolitical uncertainties. While the global economy showed signs of stabilization, reinsurers remained cautious about claims cost inflation and regulatory changes impacting reserving practices.

Demand for reinsurance remained robust, particularly in property catastrophe coverage, as insurers sought protection against frequent and severe natural disasters. However, with ample capacity and increasing competition, pricing softened across most property lines, especially for well-capitalized insurers. Casualty reinsurance, despite ongoing concerns over social inflation and litigation risks, experienced stable renewals with improved risk-adjusted margins.

The impact of climate change and rising secondary perils—such as wildfires, floods, and convective storms— continued to be a key concern, particularly in regions like North America, Europe, and the Middle East. Despite these challenges, reinsurers sustained profitability, driven by disciplined underwriting, strong investment returns, and diversification strategies.

In 2024, the international treaty business written by our head office recorded an increase of 5.7% in gross written premiums, totaling KRW 1,159.5 billion (USD 847.3 million, an increase of 1.9%). We secured solid market growth in the Middle East and Americas, demonstrating a well-balanced and steady expansion. On the other hand, we adjusted our portfolio in Europe by 9.2% to reduce volatility stemming from climate change, secondary perils, and social inflation.

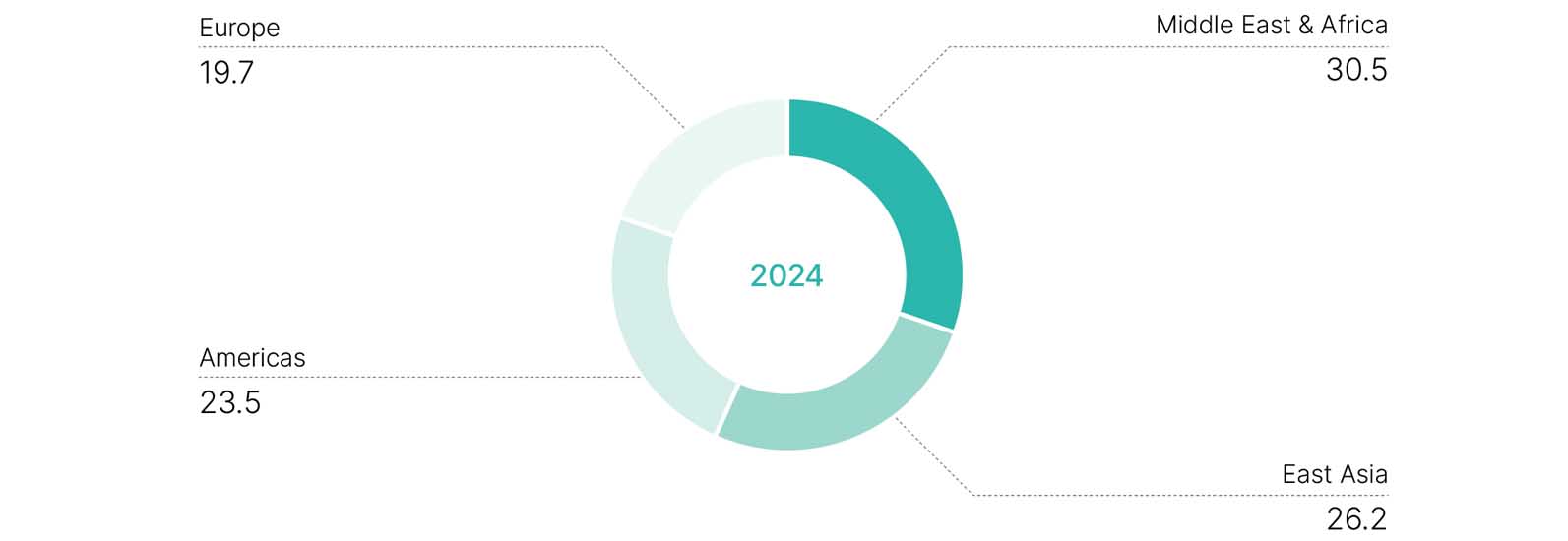

Notably, our property, engineering & marine portfolio has comparable shares of 30.5% for the Middle East & Africa and 26.3% for East Asia, with the Americas and Europe following closely at 23.5% and 19.7%, respectively. In terms of the motor & casualty business, Europe & the Middle East make up 68.5%, while the Americas & Asia account for 31.5%.

█ International Treaty Portfolio by Region in 2024 (Property, Engineering & Marine)

(Unit: %)

Our company remains committed to expanding non-property classes of business as part of our strategy to further diversify our global portfolio. Over the past year, our share of non-property business has increased from 41.8% to 43.7%, reflecting our dedication to achieving a well-balanced risk profile across multiple lines. This shift strengthens our resilience and positions us for sustained growth in an evolving reinsurance landscape.

Our diversified international treaty portfolio underscores our commitment to serving clients worldwide. We have continued to refine our portfolio strategy by region while proactively preparing for the impact of catastrophes and large-risk losses. The absence of significant catastrophe events contributed to a record-high net underwriting income of KRW 193.8 billion (USD 141.6 million), resulting in a technical combined ratio of 83.3%.

Given the ongoing uncertainties surrounding natural disasters and economic conditions, we are continuing to place greater emphasis on enhancing profitability by strictly managing natural catastrophe exposures and adopting a more cautious approach to underwriting.

Moreover, we are actively exploring both traditional and alternative reinsurance solutions to offset the potential effects of loss volatility driven by global climate change and evolving regional market dynamics.

█ Gross Written Premiums: International Treaty

Property, Engineering & Marine

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Middle East & Africa | 199.3 | 145.6 | 195.2 | 148.0 |

| East Asia | 171.3 | 125.2 | 167.0 | 126.6 |

| Europe | 128.6 | 94.0 | 141.7 | 107.4 |

| Americas | 153.5 | 112.2 | 134.6 | 102.0 |

| Total | 652.7 | 477.0 | 638.5 | 483.9 |

* Individual figures may not add up to the total shown due to rounding.

Casualty & Motor

(Units: KRW billion, USD million)

| 2024 (KRW) | 2024 (USD) | 2023 (KRW) | 2023 (USD) | |

| Europe & Middle East | 347.3 | 253.8 | 288.2 | 218.4 |

| Americas & Asia | 159.6 | 116.6 | 170.6 | 129.3 |

| Total | 506.8 | 370.3 | 458.8 | 347.7 |

* Individual figures may not add up to the total shown due to rounding.

█ Gross Written Premiums: International Treaty

Property, Engineering & Marine

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Middle East & Africa |

199.3 |

145.6 |

195.2 |

148.0 |

East Asia |

171.3 |

125.2 |

167.0 |

126.6 |

Europe |

128.6 |

94.0 |

141.7 |

107.4 |

Americas |

153.5 |

112.2 |

134.6 |

102.0 |

Total |

652.7 |

477.0 |

638.5 |

483.9 |

* Individual figures may not add up to the total shown due to rounding.

Casualty & Motor

(Units: KRW billion, USD million)

2024 (KRW) |

2024 (USD) |

2023 (KRW) |

2023 (USD) |

|

Europe & Middle East |

347.3 |

253.8 |

288.2 |

218.4 |

Americas & Asia |

159.6 |

116.6 |

170.6 |

129.3 |

Total |

506.8 |

370.3 |

458.8 |

347.7 |

* Individual figures may not add up to the total shown due to rounding.